U.S. government releases IRA’s prevailing wage and apprenticeship requirements

With the release of its wage and apprenticeship requirements, the IRA has included a myriad of incentives including the production tax credit, investment tax credit, energy community adder, and more. But to take advantage of these, renewable energy project developers must meet specific guidelines as far as pay, the number of apprentices employed and the ratio of workers who come from qualified apprenticeship programs.

By following the newly released rules, the Treasury said in a statement, “Taxpayers can claim an increased credit equal to five times the base incentive. This includes projects utilizing the investment and production tax credits that help finance utility-scale wind, solar, and battery storage projects, as well as for credits for carbon capture, utilization, and storage and clean hydrogen projects.”

The goal of the prevailing wage and registered apprenticeship (PWA) provisions in the IRA is to ensure that those working in the clean energy industry receive fair pay and also to encourage apprenticeship programs that will build a skilled workforce.

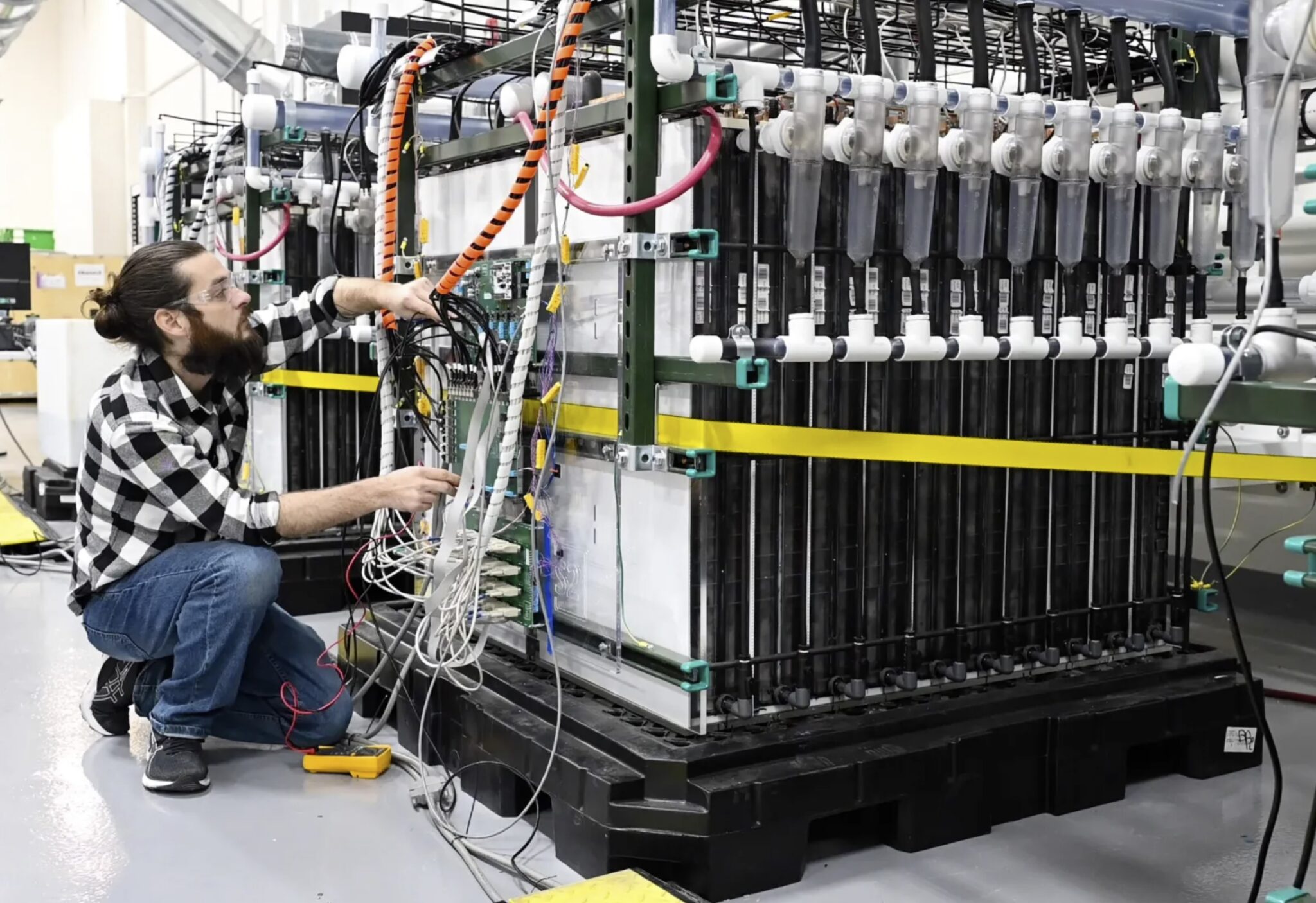

More than 270,000 jobs created already

The clean energy projects that resulted from the IRA have created more than 270,000 jobs, according to the Treasury Department, which said studies show that more than 1.5 million additional jobs will be created over the next decade. The Department of Labor released an interactive map that shows clean energy projects across the country that could be eligible for enhanced tax incentives if taxpayers satisfy the prevailing wage and registered apprenticeship provisions, as well as other applicable IRA requirements.

“President Biden’s Inflation Reduction Act has driven an investment boom while ensuring that workers building the clean energy economy benefit from good pay and new opportunities to get ahead,” said Secretary of the Treasury Janet L. Yellen. “Treasury’s final rules ensure we have skilled workers ready to take advantage of the jobs being created by these historic investments.”

President Biden’s Inflation Reduction Act has driven an investment boom.

The PWA requirements took effect in January 2023, after which time more than 300 public comments were received and considered, according to Treasury, in developing the final rules.

Details of the final rules include:

- Requiring that determinations of prevailing wage rates be made by DOL, consistent with the Davis-Bacon Act;

- Incentivizing practices that will encourage contemporaneous compliance;

- Implementing strong recordkeeping requirements;

- Guaranteeing that taxpayers with projects covered by qualifying project labor agreements do not need to pay penalties; and

- Clarifying apprenticeship requirements such as clearly defining what constitutes a request for qualified apprentices, what constitutes a response, and when the good faith effort exception applies.

Departments of Treasury and Labor encourage developers to consider project labor agreements (PLA), which reportedly can help taxpayers comply with the PWA requirements. To better understand PLAs, read the blog “Project Labor Agreements: A Best Practice for Clean Energy Projects Seeking to Meet IRA Wage and Apprenticeship Standards” by Deputy Secretary of the Treasury Wally Adeyemo and Acting Secretary of Labor Julie Su.

The IRS said it plans to “dedicate significant resources to promoting and enforcing compliance with the final clean energy rules”. One of those resources will be a new PWA fact sheet that provides a summary of the requirements and as well as how to alert the IRS of suspected tax violations related to the PWA increase.

Furthermore, the Labor Department and the IRS will sign a Memorandum of Understanding (MOU) by the end of the year that is intended to facilitate public outreach, education and development of training content for IRS examination personnel who will be tasked with ensuring PWA compliance.

The IRA will create and maintain good-paying, union jobs in the clean economy.

“One of the greatest promises of the Inflation Reduction Act is that it will create and maintain good-paying, union jobs in the clean economy while building inclusive pathways into the highest quality training for lifelong careers in construction,” said Jason Walsh, executive director of the BlueGreen Alliance. “With this rule, we are seeing how that promise will come to fruition. We are excited to see this progress and look forward to continuing to work with the administration to ensure that the Inflation Reduction Act delivers for workers and communities across the country.”

An unpublished rule is available here. On June 25, 2024, the IRS will publish the rules here.