China’s battery price war catalyses global energy storage innovation

China’s energy storage sector is undergoing a radical transformation as a fierce battery price war fuels unprecedented innovation and competition. The recent 12th Energy Storage International Conference and Expo (ESIE) in Beijing showcased this seismic shift, setting the stage for a new era in the world’s largest energy storage market.

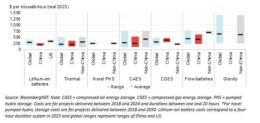

Prices have nosedived, with turnkey energy storage systems plummeting to $90 per kilowatt-hour (kWh) from $180/kWh and battery cells to $47/kWh from $106/kWh compared to a year ago. This dramatic decrease is not only reshaping market dynamics but also sparking rapid advancements in product offerings.

At ESIE, over 200 new products were unveiled, with more than 400 presentations captivating an audience of 200,000. This massive event underscored the intense competition among energy storage providers, now focusing on differentiated products with enhanced performance and longevity.

Product differentiation and enhanced lifetimes

Sungrow’s PowerTitan2.0, an integrated energy storage system, exemplifies the industry’s pivot towards more efficient and compact designs. This system slashes land usage by 29%, requiring only 20 square metres per megawatt-hour, and offers significantly quicker installation times. Meanwhile, CATL’s 6.25MWh TianHeng system, featuring colossal 587Ah cells, decreases land usage by 20% and boasts zero-capacity degradation for the first five years. BYD’s MC Cube-T system further raises the bar with a 6.43MWh capacity and a 25% reduction in footprint.

Despite these ground-breaking advancements, many companies struggle to convince customers of the value of improved lifetimes and performance. The market is primarily driven by mandates to integrate storage with renewable energy projects, rather than the economic benefits of higher-performing systems. This lack of appreciation for performance enhancements has forced companies to innovate relentlessly to stay ahead.

Global impact and future outlook

Globally, the energy storage market is experiencing explosive growth. Deployments in 2023 skyrocketed to 44 GW/96 GWh, nearly tripling the previous year’s figures. BloombergNEF forecasts that 67 GW/155 GWh will be added in 2024, a staggering 61% increase in gigawatt-hour terms. China continues to lead installations, driven by provincial mandates, while significant activity is also seen in the US, Australia, Japan, South Korea, and Europe.

The plummeting costs of energy storage, driven by China’s relentless price war, are expected to catalyse more economic deployments worldwide. Lithium iron phosphate (LFP) batteries are surging in market share due to their lower costs and higher cycle life compared to nickel-based lithium-ion batteries. This trend is set to continue, with LFP dominating the energy storage sector due to its suitability for stationary systems where weight and space are less critical.

Impact on Indian markets

The shockwaves from China’s battery price war are set to reverberate across India, a burgeoning market for renewable energy and energy storage. India’s energy storage market stands to gain significantly from the reduced costs and technological advancements emanating from China. With India’s ambitious renewable energy targets, the integration of cost-effective and efficient energy storage systems is crucial.

Lower battery prices could make large-scale energy storage projects more economically viable in India, facilitating greater adoption of solar and wind energy. As a result, India’s energy storage capacity is expected to surge, driven by both central and state-level policies promoting renewable energy integration.

Indian companies may also find lucrative opportunities to collaborate with Chinese firms or adopt their advanced technologies, leading to enhanced performance and cost-efficiency of energy storage solutions in the Indian market. This could significantly boost the reliability and stability of India’s power grid, supporting the country’s transition to a more sustainable energy future.

Challenges and opportunities

Despite the aggressive cost reductions, the market faces several formidable challenges. The intense competition in China, leading to an oversupply of battery cells, has forced large manufacturers to cut margins to edge out smaller competitors. This raises concerns about the sustainability of such rapid cost declines.

Moreover, the industry’s ability to improve utilisation rates and effectively integrate with power market reforms remains a crucial factor for future growth. The global market must address infrastructure bottlenecks, streamline permitting processes, and develop new revenue streams to sustain its momentum.

In conclusion, the battery price war in China is propelling the energy storage market into a new phase of innovation and competition. With prices at historic lows and companies pushing the envelope on technology and efficiency, the future of energy storage looks incredibly promising. However, the industry’s long-term success will depend on its ability to navigate challenges and capitalise on emerging opportunities. The impact on India and other global markets is likely to be profound, driving further growth and integration of renewable energy sources worldwide.