Battery heavyweights reaffirm commitment to solid-state technology

As lithium-ion batteries continue to improve in terms of both performance and cost, it is becoming increasingly difficult for alternative technologies to challenge the incumbent. However, interest in solid-state batteries, which promise better energy density and safety, has not waned, judging by recent announcements.

South Korea’s Samsung SDI is moving toward mass production of its all-solid-state battery technology with an energy density of 900 Wh/L. This week, the company is unveiling a technology roadmap at the InterBattery show in Seoul.

The document will demonstrate that every aspect of its plan for mass producing all solid-state batteries in 2027 is well on track, from development production line project launch to supply chain management, Samsung SDI said in a statement.

Our preparations for mass-producing next-generation products of various form factors such as all solid-state battery are well underway.

In December 2023, Samsung SDI established a dedicated team to promote the commercialization of its all solid-state business. Previously, it set up a pilot in its R&D Center in Suwon last year and is currently delivering proto samples.

“Our preparations for mass-producing next-generation products of various form factors such as all solid-state battery are well underway,” said Samsung SDI President and CEO Yoon-ho Choi.

Like CATL, BYD and Toyota, Samsung’s solid-state technology is based on sulfide-based solid electrolytes, which have the highest lithium ion conductivity compared to other solid state electrolytes. All solid-state batteries developed by Samsung SDI stand out for their anode-less configuration which is said to offer improved performance compared to devices featuring lithium metal anode and solid electrolyte.

Samsung’s roadmap release comes hot off the heals of the announcement of a Chinese national alliance of automakers and battery giants, including BYD, CATL, and Nio, aimed at developing all solid-state batteries.

In a bid to build a supply chain for solid-state batteries by 2030, Beijing in January set up a consortium, the China All-Solid-State Battery Collaborative Innovation Platform (CASIP), which brings together government, academia, and industry.

China dominates the global battery market

China already dominates the global battery market and looks determined to stay on top by boosting research and development of next-gen battery technologies, such as solid-state batteries which are particularly suited for electric mobility applications.

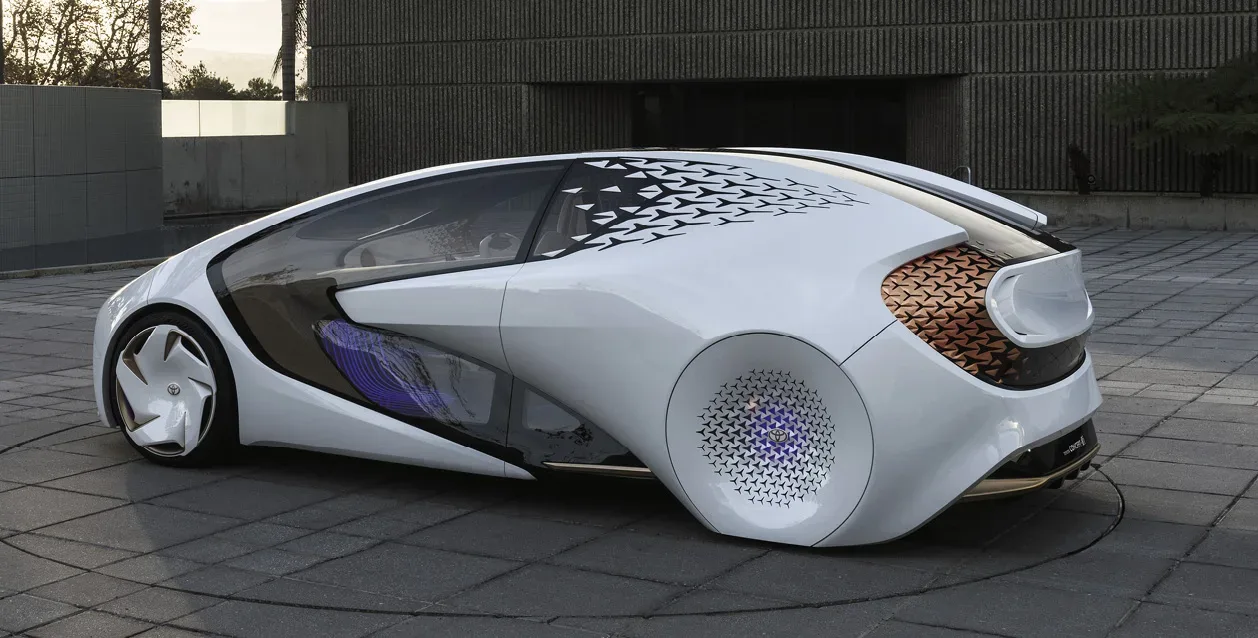

Among automakers, Japanese Toyota Motors has taken the lead with more the 1,000 solid-state battery patents. Last month, it said that it is preparing to mass-produce solid-state batteries by 2027 or 2028.

Nissan and Honda have previously revealed plans to establish solid-state battery manufacturing lines in-house. Meanwhile, Western automakers such as Volkswagen, Mercedes-Benz, Stellantis, BMW, and Ford are also exploring solid-state batteries through partnerships with startups.

However, the production of solid-state batteries at scale is still held back by technological challenges and high costs, with industry analysts warning of a relatively tough path toward mass production in the coming years.