Poland’s new capacity market auction could hamper BESS

Poland’s battery revolution is in the starting blocks, but a newly proposed regulation could hamper it from reaching its full potential.

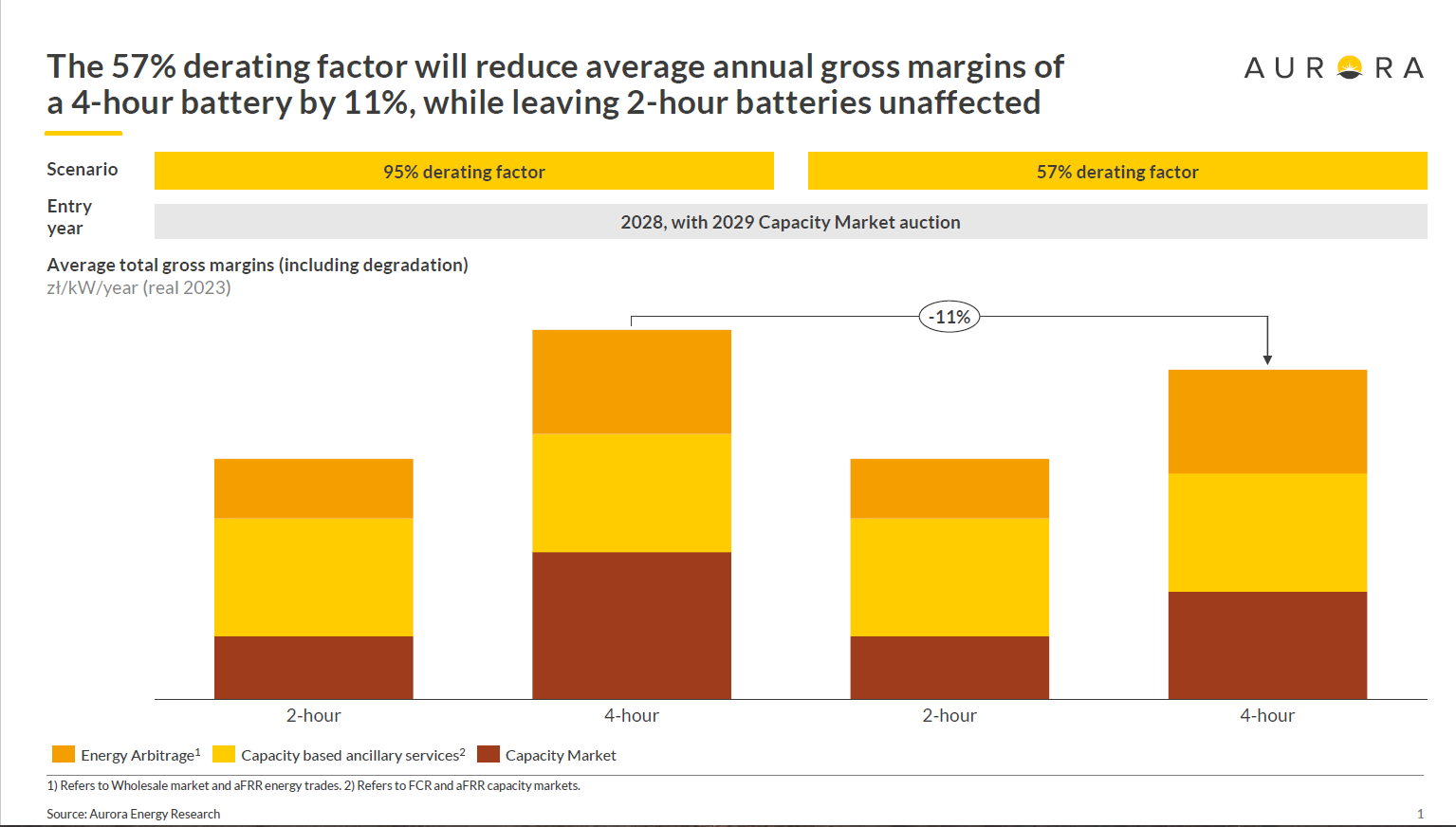

Earlier this week, a draft ordinance outlining the parameters for this year’s procurement exercise was published (here: https://lnkd.in/eGhde6ft). One of its key parts was a proposed reduction to the BESS derating factor from 95% to 57.6%.

A derating factor is a multiplier applied to the actual generation capacity of a unit to determine the maximum size of contract it can secure in the capacity market auction. It is based on the expected availability of the dispatchable capacity in hours when demand is highest.

For example, with the new 57% derating factor, a 100 MW battery would be able to secure a contract covering 57 MW of capacity. Investors would usually contract even less than that to make sure they are able to fulfill their capacity obligation.

“Derating factors don’t necessarily need to be duration specific,” says Grzegorz Walkowski, senior associate at Aurora Energy Research, tells pv magazine Energy Storage. “In the Polish market, units are expected to produce their contracted capacity for four hours, leaving investors to adapt their strategy based on their storage duration and repowering plans. This is generally positive as it allows the market to determine the most effective approach.”

However, this also means that the draft parameters could be particularly harmful for BESS with four-hour storage duration. “In case of two-hour BESS, developers have anyway been choosing derating factors around 40-45% to account for the need to deliver the capacity obligation for four hours, and the new derating factor doesn’t force this to change,” says Walkowski. “However, security of supply will not benefit from incentivizing investments into shorter-duration storage.”

Poland’s last capacity market auction was the first one to catalyze large amounts of BESS. Unlike previous ones, which mainly generated subsidies for existing and new coal and gas-fired power plants, the eighth capacity market auction held in December last year procured as much as 1.7 GW of energy storage. Only 165 MW was secured in the seventh auction.

The nation’s upcoming 2024 capacity auction will have a cumulative procurement target of 5.7 GW. This would mean 18 GW of contracted derated capacity in 2029, down from 21 GW in 2028. The target is set with the assumption that 6 GW of uncontracted coal capacities will remain operational in 2029.

Polish transmission network operator PSE calculates that the capacity market price for combined-cycle gas turbines is 575 PLN/kW – far above the 488 PLN/kW price cap. Therefore, according to Walkowski, the prospect of new gas entering the market on a large scale is increasingly distant.

“Based on this, 2029 will bring extended periods of high prices. Great for BESS, less so for consumers,” Walkowski says. “The Capacity Market clearing price is also likely to be much higher than last year, as BESS developers adjust their strategies to the new derating factor while facing limited competition from other technologies.”

Poland’s next capacity market auction takes place against the backdrop of the highest curtailment of renewable energy generation on record. According to the PSE data, up to May 6, 2024, a total of 319.6 GWh of electricity was subject to non-market redispatch. This included 279.7 GWh of PV generation and 39.9 GWh of wind generation. For comparison, only 74.4 GWh were curtailed throughout 2023.