TWAICE, NARDAC team to improve insurance terms with battery storage analytics

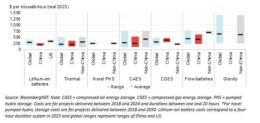

While prices have been on a downward trajectory, developing BESS assets still requires substantial investment and therefore long-term performance of the asset is key to making these projects profitable.

A new partnership between German battery analytics technolgy provider TWICE and NARDAC, UK-based insurance broker focused on large energy and infrastructure assets, is looking to pool expert resources and know-how in the field to improve BESS insurance coverage and secure a sustainable business for project owners, investors and lenders in the long run.

The companies are looking to combine proactive real time analytics with existing, passive mitigation strategies, such as physical spacing. This should help identify best practice in BESS project development and operations and thereby make it easier for insurers to offer improved coverage terms.

“In partnering with NARDAC, we are able to offer tangible financial benefits to the entire energy storage market,” said Stephan Rohr, CEO of TWAICE. “With battery analytics like TWAICE’s, the risk of a safety incident is lowered thanks to our autonomous monitoring and analytics that detect issues before they spiral into a damaging event.”

TWAICE’s software warns about risks in advance, giving time to proactively mitigate any potential incidents. Thereby, project risks are reduced, enabling improved insurance terms from underwriters.

High-profile safety incidents involving fire and explosions have harmed the battery storage industry’s reputation, making it difficult to secure insurance coverage. However, recent research from TWAICE in partnership with the Electric Power Research Institute (EPRI) and Pacific Northwest National Laboratory (PNNL) shows that the likelihood of failures has decreased by 97% since 2018.

But while the frequency of thermal runaway events has fallen, the severity remains high, leaving insurers exposed to multi-million dollar claims. Meanwhile, as BESS projects continue to proliferate globally, the insurance capacity available for operators to secure against their projects has dwindled.

The pipeline for BESS projects globally is game-changing for further deployment of renewable energy.

Therefore, NARDAC started underwriting BESS projects in March this year. It said that its new syndicated offering would provides BESS developers and operators with $50 million in underwriting capacity per location, offering the BESS industry much needed extra capacity.

“The pipeline for BESS projects globally is game-changing for further deployment of renewable energy. But if underwriters don’t see a way forward on better management of risks like thermal runaway, then insurance capacity will be reduced – lifting premiums – financing will be harder to secure, and battery development costs will remain high,” said Tom Harries, Partner, NARDAC.

Insurance is not just a binary relationship

Harries underlines that insurance is not just a binary relationship between cost and outsourced risk. “In the operational phase for BESS projects, prudent asset managers can use insurance as a competitive advantage. Those that run assets with minimal oversight will face insurance premiums that are a disproportionately high share of operating costs. But complimenting existing hardware and site layout strategies with advanced battery analytics will lower your project’s risk of large, thermal runaway events,” he says.

In their joint whitepaper, TWAICE and NARDAC provide supporting cases to underpin the value of battery analytics for insurance coverage. The report argues that insights into the BESS health present opportunities for enhanced safety and more accurate operating costs in insurance policies.