Bulgaria’s battery storage market gears up

Sepehr Soltani, lead energy storage analyst at Norwegian consultancy Rystad Energy told the RE-Source Southeast Conference that took place in Sofia, Bulgaria, in May that Bulgaria offers the highest revenue potential for battery storage in Europe.

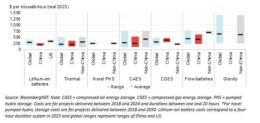

Specifically, according to data presented by Soltani at the RE-Source Southeast Conference, Bulgaria’s electricity market offers an opportunity for €110 per MWh profit with a battery energy storage system with two hours of discharge capacity using energy arbitrage. Rystad Energy’s analysis has set the battery system costs at a flat €60 per MWh.

Despite this opportunity, the conference argued that until recently energy storage was not a big thing in Bulgaria and this is due to Bulgaria’s plentiful operational coal and nuclear capacities. Nevertheless, the country needs to comply with the European Union (EU) rules for emissions reduction and the phasing out of coal plants is imminent. Given that renewable energies will fill the coal generation gap, the role of energy storage will need to increase too.

“In fact, we are already seeing the transition to energy storage in Bulgaria, mainly through the development of battery storage facilities behind-the-meter,” Alexander Rangelov, CEO of the International Power Supply (IPS) Group, an energy storage manufacturer headquartered in Sofia, told pv magazine.

Bulgaria has installed between 40 MWh and 50 MWh of battery capacity to date, with business models mainly based on grid balancing and arbitrage. Rather interestingly, according to Rangelov, some large consumers, such as factories, are also installing behind-the-meter battery energy storage systems even without having a renewable power generation facility on site. “They do so to reduce their electricity costs via self-consumption of the energy stored during times of low electricity prices,” he says.

Another development that can boost battery storage in Bulgaria is a recent update of the national legislation to include battery energy storage systems as a component of the grid.

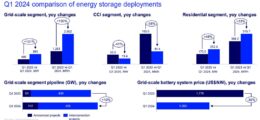

“Previously, battery systems were only used for self-consumption and back-up purposes, we believe that new business opportunities arise now. The legislative update coupled with new financing by the European Union’s Recovery and Resilience Facility mean that about 1000 MWh of new battery capacity is expected to be connected to the grid within the next two years. This capacity will be used for both solar peak shaving and grid balancing,” Rangelov said.

Bulgaria’s Ministry of Energy is currently running two tenders aiming to commission 1,425 MW of solar and wind generation capacity coupled with 350 MW of behind-the-meter energy storage. The deadline for submitting project proposals was June 12, 2024 and the ministry accepted bids from companies in all sectors apart from agriculture, forestry, and fishery. So far, the government hasn’t announced plans to tender in front of the meter energy storage capacity.

Local content requirement

In conversation with pv magazine, Rangelov also expressed concerns about Bulgaria’s treatment of European battery storage manufacturers. He said that both the IPS Group and other manufacturers are very disappointed that the section referring to battery energy storage systems in Bulgaria’s recently published Recovery and Resilience Facility (RRF) does not have any minimum technical requirements, neither performance guarantees, nor anything about cybersecurity. Additionaly, there is no support for EU battery system manufacturers.

“Considering the RRF subsidy is 50%, we believe the EU content of battery systems should have been supported in Bulgaria’s RRF, similarly to the other countries that went through the same RRF procedure for battery storage systems. This is a serious problem that cancels the bloc’s efforts to build European battery storage manufacturing capacity and reduce reliance to China,” Rangelov said.

Phasing coal out matters

Finally, the speed at which Bulgaria is planning to phase out coal will play a crucial role in the development of a local battery energy storage ecosystem.

According to Low Carbon Power, a Taiwan-based non-governmental organisation monitoring the transition to low carbon energy, Bulgaria’s electricity mix last year comprised about 9% of solar, 8% of hydro, 5.5% of biofuels, 4% of wind, 4% of gas, 29% of coal and a staggering 40.5% of nuclear power.

On the energy storage front, except the 50 MWh of installed battery capacity, Bulgaria’s only other installed storage capacity is a large 1.2 GWh pumped-hydro facility. The country’s grid balancing is currently done by the rotating generators in the thermal and nuclear power plants. Therefore, the coal phasing-out date is important, but this has changed several times for political reasons.

As of now, 2035 seems to be the actual phasing-out deadline, according to Rangelov. Ember, an independent energy think tank headquartered in the UK, has been very critical of Bulgaria, saying that in 2030, the country is going to have one of the dirtiest electricity grids in the EU, due to a high reliance on fossil fuels, especially coal. Betting on new nuclear in the 2030s to reduce emissions is a risky strategy and will not deliver the cuts required this decade, argues Ember.