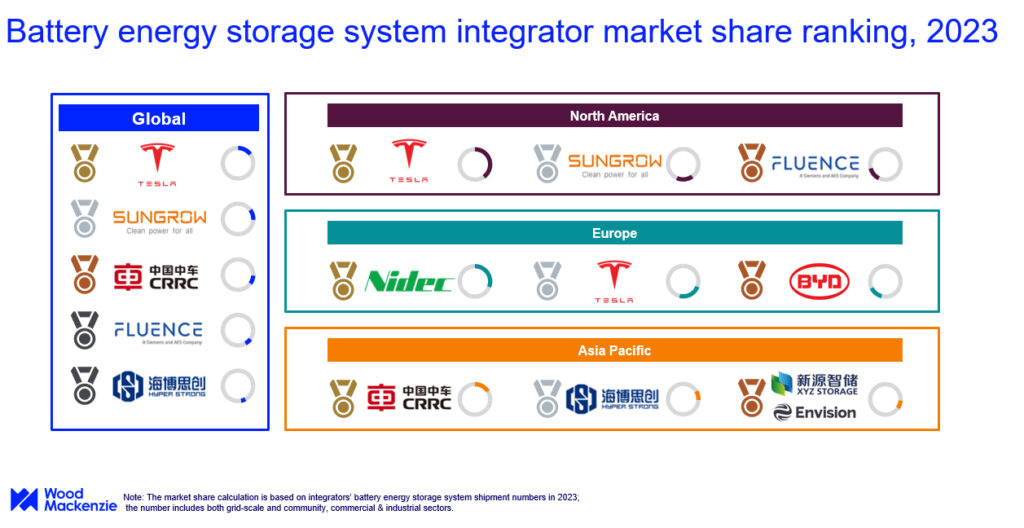

Tesla usurps Sungrow as lead BESS producer globally in 2023

In North America, the top three vendors – Tesla, Sungrow and Fluence – captured 72% of the region’s market share for BESS shipments in 2023, marking an increase for these companies of 20% YoY.

At the same time, Wood Mackenzie also reports that the US buildout of microgrids nearly doubled for commercial and industrial users in 2023, surpassing 900MW. According to the Financial Times, business owners are willing to pay high upfront costs to own private grids in order to avoid operational losses caused by power outages. Market concentration in the BESS integrator market in North America has increased significantly, mainly driven by Tesla with a 60% increase in market share YoY.

Despite the North American and European data showing Tesla delivering the most and second most BESS, respectively, the global shift comes from China as multiple China-based companies have entered the global market. Six of the “global top 10 vendors” are China-based. The Wood Mackenzie report partially attributes this to China’s BESS market being exclusively supplied by domestic companies. China also installed the most BESS globally in 2023.

The Wood Mackenzie report ‘Global battery energy storage system integrator ranking 2024’ states that the market share of the global “top five” BESS integrators shrank to 47%, down from 62% in 2022.

A battery energy storage system integrator is a company that specialises in procuring (and/or manufacturing) subsystem components, integrating hardware and software and supplying completed battery energy storage systems. Energy storage system integrators’ responsibilities vary in practice, depending on contract details, clients’ specific requirements and available resources in the market.

Kevin Shang, Wood Mackenzie’s principal research analyst for energy storage technology and supply chain, explained, “The global BESS integrator market is becoming increasingly competitive, especially in China, resulting in declining market concentration. As a sector with a relatively low entry barrier, the BESS integrator industry has attracted a significant number of new players.”

This dynamic saw the increased dominance of Chinese companies in the Asia Pacific region in 2023. CRRC jumped to the top among BESS integrators in APAC, which Wood Mackenzie attributed to cost competitiveness, followed by Hyperstrong. XYZ Storage and Envision tied in third place.

Shang noted here, “Importantly, established companies have also been bolstering their competitiveness in terms of price, performance of products and solutions across all regions.”

Europe saw greater market concentration in the energy storage system integrator market in 2023 from a more fragmented market in 2022. The main three players in Europe were Japanese electronics, automotive and battery giant Nidec, Tesla, and the Chinese automotive and battery giant BYD, together accounting for 68% of the European market share in 2023. This marks a 26% increase in market share by these players YoY.

With the rapid evolution of the energy storage industry, battery energy storage system integrators have been aiming to enhance their vertical integration along the energy storage value chain. Shang noted here that “Tesla has the energy storage industry’s most vertically integrated supply chain, from manufacturing hardware to providing energy storage solutions. This enables Tesla to deliver continued improvements and new features to clients quickly and helps customers maintain storage assets for their entire lifespan.”

Tesla has been ramping up production at its 40-GWh Megapack factory in Lathrop, California.