Fraunhofer finds European battery recycling continuing to grow at pace

German research institute Fraunhofer Institute for Systems and Innovation Research (Fraunhofer ISI) has updated its overview of current and planned battery recycling plants in Europe. The analysis finds that the expansion of the European battery industry is bringing an increase in recycling facilities, often in close proximity.

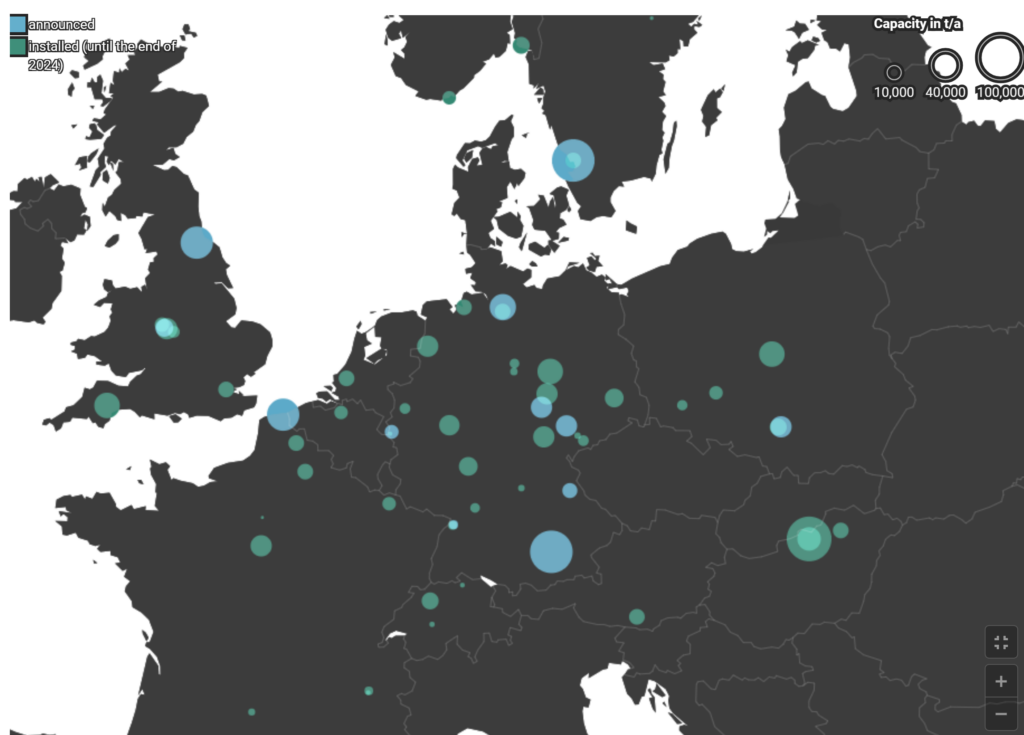

The update details many recycling sites in Central Europe, notably in Germany and France. Additional capacity is being announced in Poland and Hungary, along with Scandinavia, tracking battery manufacturing sites. Some locations and companies are facing financial difficulties, even sometimes abandoning plans.

A research paper in the journal Batteries published in 2023 found that the global battery recycling rate in 2019 was 59% and likely has risen substantially since then.

Fraunhofer ISI divides the locations into two categories according to the recycling process — facilities that proceed with the first recycling steps, such as collection, discharge, and dismantling, are called “spokes.” This process produces “black mass,” the industry term for a mixture of cathode and anode materials without separating lithium, nickel, or cobalt.

“Hubs” are the recycling facilities where further treatment is undertaken, defined as follows, where black mass “is refined using pyro- or hydrometallurgical processes or electrochemical processes” to recover both the hugely valuable metals like nickel or cobalt, along with less valuable but critical raw materials like graphite and manganese. Some facilities are both spokes and hubs in one.

Logistics tends to drive the placement of facilities, often occurring in the proximity of both battery and car manufacturers. These locations produce waste and batteries that could be used in second-life situations. These locations are especially useful for cutting down transportation of lithium-ion batteries, which are classed as dangerous goods and costly. Spokes tend to be situated in less central locations for optimal collection.

Hubs, on the other hand, when processing black mass, are often centrally and well-connected regarding infrastructure. Transportation of black mass to hubs is “not a significant concern,” writes Fraunhofer.

A screenshot of Fraunhofer’s interactive map of locations of spoke and hub for recycling facilities (Image: Fraunhofer ISI)

There is a slight mismatch in processing capacities: hubs, with approximately 350,000 tonnes per year of capacity, exceed the capacities of the spokes by 50,000 per year. Yet, Fraunhofer notes, “almost every player in European battery recycling is planning to set up several sites for its recycling activities,” and by the end of 2024, spokes will handle double 2023’s capabilities. Intriguingly, the report notes around 40 percent of spoke capacities in Europe are provided by Asian and American companies.

Looking further, “capacities in Europe are expected to reach 330,000 [tonnes per year] in 2026” and by 2030, “almost 370,000 [tonnes per year] in pretreatment capacity has been announced.”

In Germany alone, the Battery Atlas 2024 from RWTH Aachen indicated 462 GWh of annual battery production was planned before some projects faced financial pressure.