Global energy storage cell shipment: H1 2024 retrospect and prospect

The global energy storage cell shipment stood at 114.5 GWh in the first half of 2024, of which 101.9 GWh was going to utility-scale (including C&I) storage and 12.6 GWh was going to small-scale storage (including communication). In the first half of the year, the energy storage cell sector initially experienced a cool market sentiment, and then started growing steadily, up by 33.6% YoY.

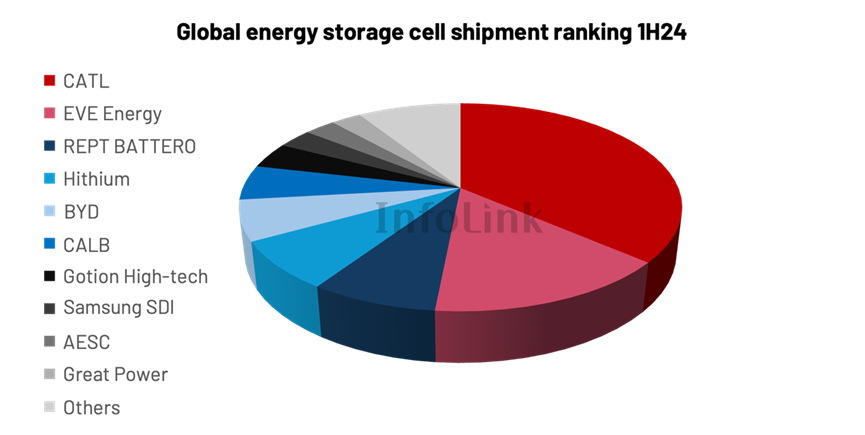

The top five largest energy storage cell manufacturers in the first half of the year are CATL, EVE Energy, REPT, Hithium, and BYD. CATL retained the first place with orders from big customers like Tesla and Fluence. Eve Energy secured the second place with orders covering other leading customers.

Competition intensifies, with industry concentration staying high. The top 10 battery cell makers delivered 91% of shipments in the first half of the year, in a historic high. Meanwhile, the steady performance of the leading makers resulted in a five-firm concentration ratio (CR5) of 73.2%, up 1.8% compared to the first quarter. Among companies ranked sixth to tenth, CALB saw significant growth, approching the top five. Korean manufacturers Samsung SDI and LG, on the other hand, saw low shipment volumes, with their combined market share falling to around 5%.

Source: InfoLink’s Global Lithium-ion Battery Supply Chain Database

*InfoLink strives for information comprehensiveness, but in case of any discrepancies with official data, manufacturers’ official data shall prevail.

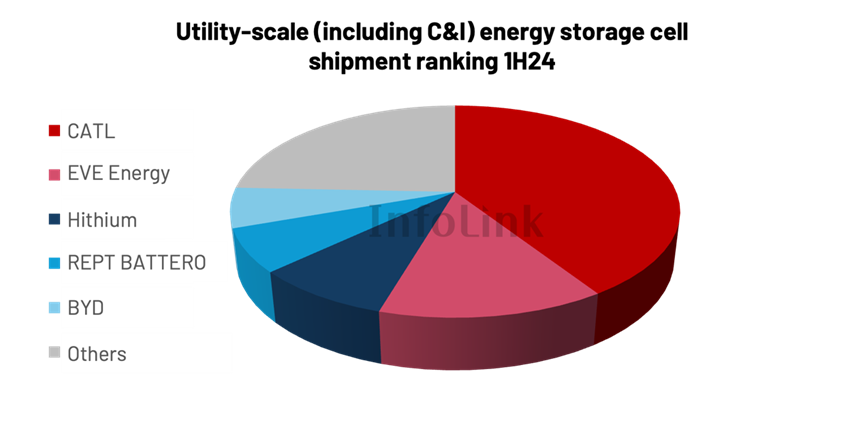

In the utility-scale sector, the top five suppliers are CATL, EVE Energy, Hithium, REPT, and BYD. The top two predominated, with CATL shipping more than 40 GWh and EVE Energy shipping nearly 15 GWh. The other three shipped less than 10 GWh, with slight differences between each other.

The June 30 installation rush drove cell shipment for the utility-scale storage market in the first half, up by 44.3% YoY. Moreover, 300Ah+ products have accounted for a market share of nearly 30% in the global utility-scale storage market now. Mainstream energy storage companies started shipping 300Ah+ products in the second quarter, which even took up more than 50% of the shipment for some manufacturers.

Source: InfoLink’s Global Lithium-ion Battery Supply Chain Database

*InfoLink strives for information comprehensiveness, but in case of any discrepancies with official data, manufacturers’ official data shall prevail.

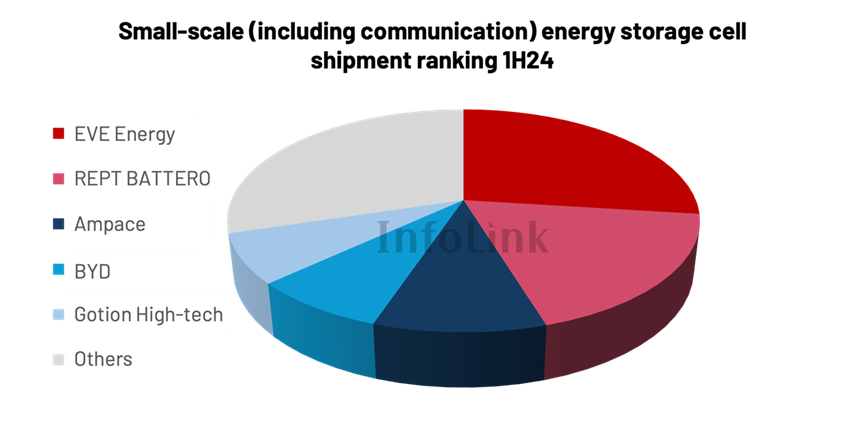

In the small-scale storage sector, the top five suppliers included EVE Energy, REPT, Ampace, BYD, and Gotion. The competition is also intensifying in this segment, with industry concentration declining further. In the first half, the CR5 decreased by 6.9% from the first quarter to 70.3%.

EVE Energy took up a market share of more than 25%, retaining its first position. REPT remained stable, securing nearly 20%. Companies ranked from third to fifth accounted for a market share of 7% to 10%. Ampace’s market share slightly recovered, returning to the top three. Gotion entered the top five with its strong performance in the communication sector.

Source: InfoLink’s Global Lithium-ion Battery Supply Chain Database

*InfoLink strives for information comprehensiveness, but in case of any discrepancies with official data, manufacturers’ official data shall prevail.

Global energy storage system shipment

The global energy storage system shipment volume stood at 90 GWh in the first half of this year. The top five BESS integrators on the AC side are Tesla, Sungrow, CRRC ZHUZHOU INSTITUTE, Fluence, and Envision, having shipped more than 30 GWh together. The top five BESS integrators on the DC side are CATL, BYD, HyperStrong, RelyEZ Energy, and Narada Power, which together shipped more than 20 GWh.

In both categories, the top two manufacturers account for the lion’s share of shipments, leaving the rest far behind.

On the DC side, CATL retained the global number one position, and continues to strengthen its capability in system integration, gradually raising the ratio of cell shipment for the DC side. BYD, with better global operating capabilities, saw domestic and global shipment growing evenly, coming in at the second position this time. HyperStrong, an established system integrator, has sustained the leading position for years, securing the third place. The company will shift focus to expanding business in foreign markets in the second half of 2024.

On the AC side, Tesla secured the first position. The company has adopted an aggressive pricing strategy since the beginning of this year, securing more orders. Attention should be paid to the construction progress of the megapack factory in Shanghai in the second half of 2024. Sungrow, with better supply chain management and comprehensive overseas channels, ranked second. CRRC Zhuzhou Institute claimed the third place on the back of its stellar performance in the Chinese market. Watch for the company’s expansion into foreign markets in the second half of the year.

About the author:

Robin Song is an energy storage analyst at InfoLink Consulting, focusing on lithium ion battery supply and demand analysis. He also provides insights on energy storage market trends. He previously worked for a leading lithium-ion battery manufacturer, where he provided market and investment analysis.