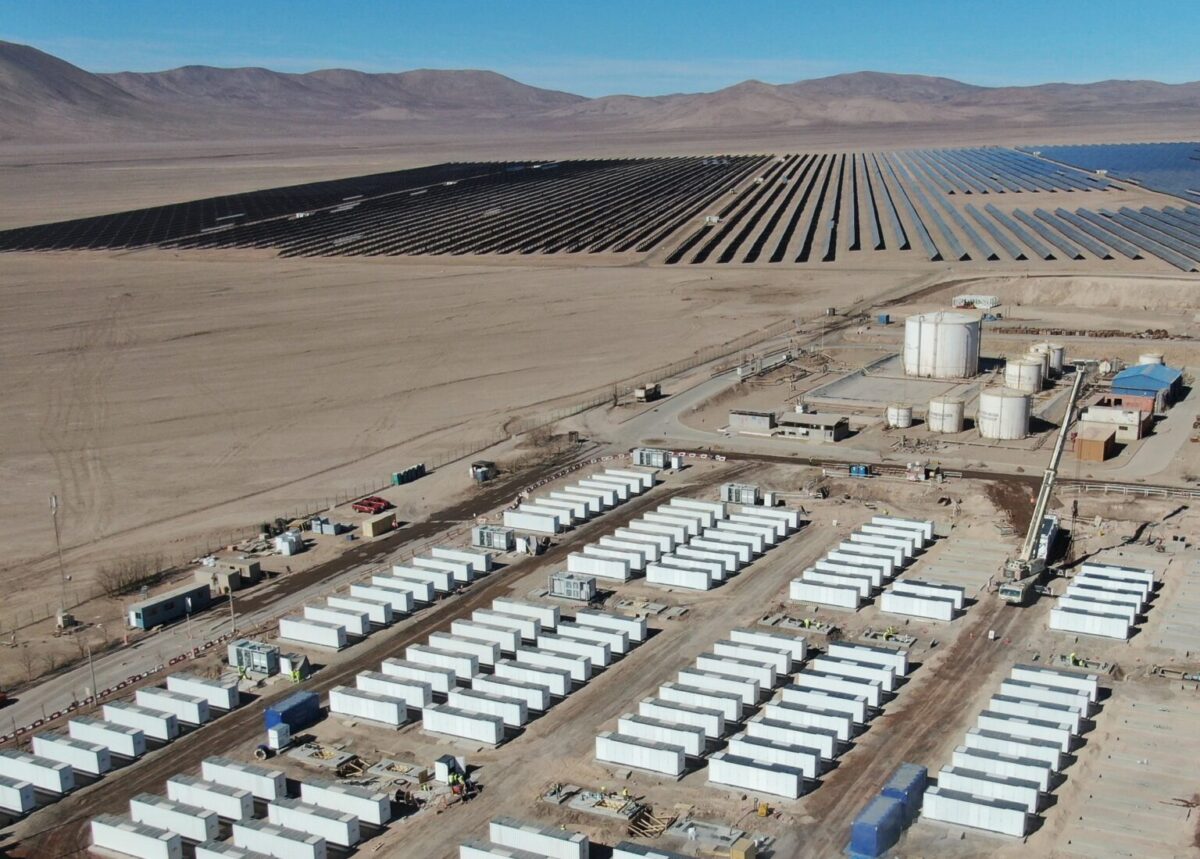

Batteries cheaper than new thermal plants for Brazil’s reserve grid capacity

Aurora has estimated battery energy storage systems (BESS) now cost 10% less to provide reserve capacity for Brazil’s grid than new combined cycle gas turbine (CCGT) power plants.

With that difference applying to projects constructed to reinforce Brazil’s grid from 2030 onwards, Aurora said BESS could be 29% cheaper if their components were subject to the same Brazilian tax regime as solar panels.

“In Brazil, 30% of the cost of installing storage is represented by taxes,” said Inês Gaspar, Aurora’s head of Latin America research. “In other countries we monitor, this is 5% to 10%.”

The cost projections can be seen below in a graph taken from Aurora’s research. The chart illustrates how other grid reserve capacity technology stacks up against CCGT plants, with “base case” referring to costs under the current tax regime and “upside” referring to the cost if battery projects paid the equivalent taxes of solar panels.

In August 2024, Markus Vlasits, chair of energy storage trade body the Associação Brasileira de Soluções de Armazenamento de Energia, told pv magazine large-scale energy storage projects costs were around BRL 1,500 ($275) per kilowatt-hour of storage capacity and were set to continue falling.

Auctions

In mid September 2024, the Brazilian government opened consultation on plans for a capacity reserve auction to be held in June 2025 exclusively for battery storage.

“The government’s decision to limit participation to four-hour batteries was strategic, since, with previous rules (that is, if we looked at the auction announced now, for 2024, and if the rules were similar), two-hour batteries could participate and would be more profitable due to their lower capex [capital expenditure cost], even when paying penalties for not being available when called,” said Aurora’s Gaspar. “This four-hour rule is fundamental to ensure that the contracted capacity truly supports the security of the system.”

With a potential batteries-only capacity reserve auction on the horizon, Gaspar cast doubt on whether the 2024 procurement exercise, for thermal and hydroelectric plants will take place.

“We made estimates and for it to happen this year, the ordinance would have [had] to be issued in mid-September [2024],” said Gaspar.

Failure to hold that exercise could cast doubt on the viability of any planned battery auction, said the analyst, adding it was unusual to hold capacity auctions for specific sources of grid capacity. It is more common to distinguish between new and existing projects, Gaspar said.

Aurora has calculated a mix of 40% four-hour BESS, 30% open-cycle gas turbine, and 30% CCGT power plants could reduce customer energy bills 5% to 24% and lower emissions 37% to 99%, compared to a purely thermal auction.

Referring to capacity reserve auctions, or Leilões de Reserva de Capacidade (LRCAP), Aurora’s Gaspar said, “Our calculations show that including some batteries to accommodate this auction demand could already significantly reduce the costs passed on to consumers in the LRCAP tariff, in addition to the benefit of cutting CO2 emissions by up to 99% by avoiding dispatching thermal plants at peak [grid demand] times.”

The Aurora study can be accessed here.

From pv magazine Brasil.