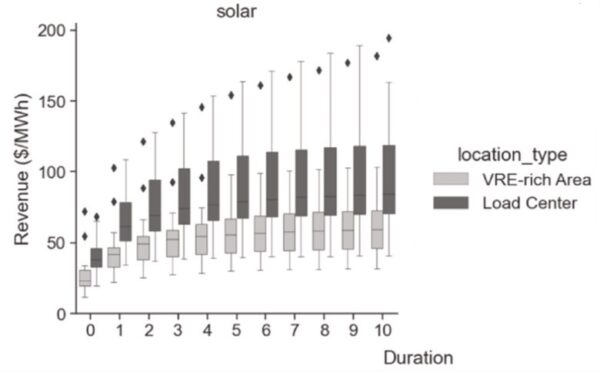

Retrofitting batteries increases solar plant revenue 29%, to 81%

Power grid queues are increasingly dominated by solar power projects, with a significant portion involving solar-plus-storage (hybrid) facilities. In recent years, Texas’s ancillary markets and California’s evening peak demand have been the primary targets for battery investments. As these markets grow more competitive and battery costs continue to drop, developers are exploring new opportunities to maximize value, such as retrofitting existing solar power plants. Industry leaders like NextEra and BayWa r.e. have indicated that retrofits will be a key revenue driver moving forward.

As expected, the study found that solar-plus-storage power plants located near high-demand areas, which face constraints in building new capacity and experience higher energy prices, could achieve significant revenue increases. Additionally, regions with abundant variable renewable energy (VRE), such as solar and wind, also benefited from adding short-duration battery storage.

In Texas, for example, battery storage is typically sized for one-hour capacity, while in California, it averages around four hours.

In modeling scenarios with increasing amounts of energy storage paired with solar facilities, the researchers observed notable differences: solar plants in load center regions saw substantial revenue gains, while VRE-rich regions showed higher percentage increases. This reflects the higher energy costs in load centers, as opposed to VRE-dominated areas where prices are often suppressed, yet large “duck curve” opportunities are present.

The most significant percentage increase in revenue per kilowatt-hour came from adding an initial one-hour battery upgrade.

From pv magazine USA.