“Expansion of privately-owned Chinese BESS integrators overseas is inevitable”

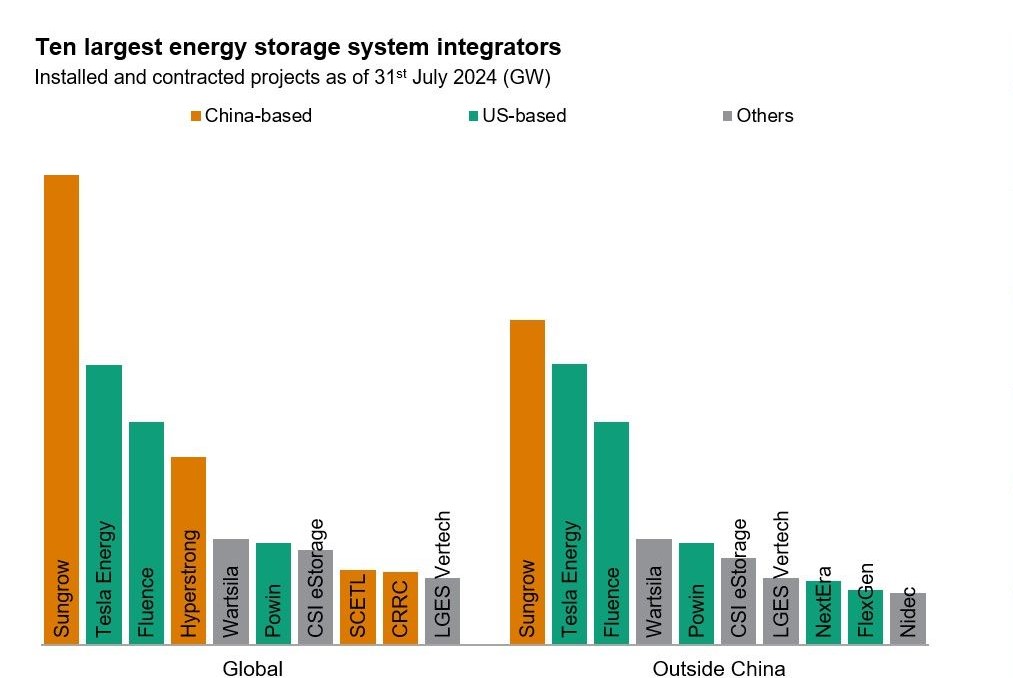

China’s Sungrow has usurped Fluence as the leading global BESS integrator in the 2024 rankings composed by S&P Global Commodity Insights, a testament to the rapid expansion of Chinese players in the global market.

Looking at the total pipeline of installed and contracted projects across the globe, Sungrow has cemented itself in the top position, followed by Tesla Energy, Fluence, HyperStrong, and Wärtsilä Energy.

Outside of China, the rankings look slightly changed, with Sungrow again leading the pack, followed by Tesla, Fluence, Wärtsilä Energy, and Powin.

“Sungrow has the most diversified customer base across all large-scale markets thanks to its established inverter business. Western suppliers don’t have access to China’s BESS market, which accounts for more than half of the global BESS demand. They also hold a significant contracted project pipeline with very large sizes in markets outside of China,” Anqi Shi, principal analyst, batteries and energy storage, at S&P Global, tells ESS News.

Some of the landmark agreements Sungrow made over the course of the previous year include, a 7.8 GWh supply deal with Saudi Arabia’s Algihaz Holding in July – which at the time was also the world’s largest and only a month later overshadowed by a Tesla US deal for 15.3 GWh. Furthermore, the Chinese manufacturer has agreed to deliver 880 MWh to Atlas Renewables in China, 800 MWh to Engie in Belgium, and 640 MWh to SSE Renewables in the UK, and the list goes on.

China’s energy storage market grew nearly 250% in 2023 and is dominated by domestic players. This has propelled four China-based integrators into the top ten – Sungrow, HyperStrong, SCETL, and CRRC.

“The Chinese energy storage suppliers established by state-owned power generation and electrical equipment enterprises have been growing very fast in the past one or two years, taking places in China’s top 10 rankings. This has squeezed the market opportunities for privately-owned companies and pushed them even harder to expand overseas,” Shi says.

However, to date, only one Chinese company appears in the global ranking if the Chinese market is excluded – Sungrow, but the competition is intensifying.

“The competition in China leaves a very thin to zero margin for system integrators now, so it’s inevitable that the privately-owned Chinese integrators will continue expanding overseas,” Shi says. “It’s also possible that we see more Chinese integrators who haven’t had a large global expansion becoming OEMs for Western integrators. This enables Western players to access the low-cost supply chain in China, and Chinese players to access a higher revenue margin in overseas markets.”

Recent collaboration announcements between Western system integrators and their Chinese peers include Fluence – Hyperstrong, and Wärtsilä – RCT Power.

Outside of China, different trends can be observed, with the United States and Australia markets dominated by US-headquartered integrators. On the other hand, Europe’s competitive environment is much more diverse.

“Another trend is a few developers in the US, China, and Germany are favoring a self-integration approach instead of hiring system integrators, which narrows the share of the market for dedicated system integrators,” Shi says.