Belgian capacity auctions catalyze 1.1 GW of battery storage

Belgium’s storage fleet is growing at a fast pace, not the least due to the opportunity to secure contracted revenues via its CRM auctions.

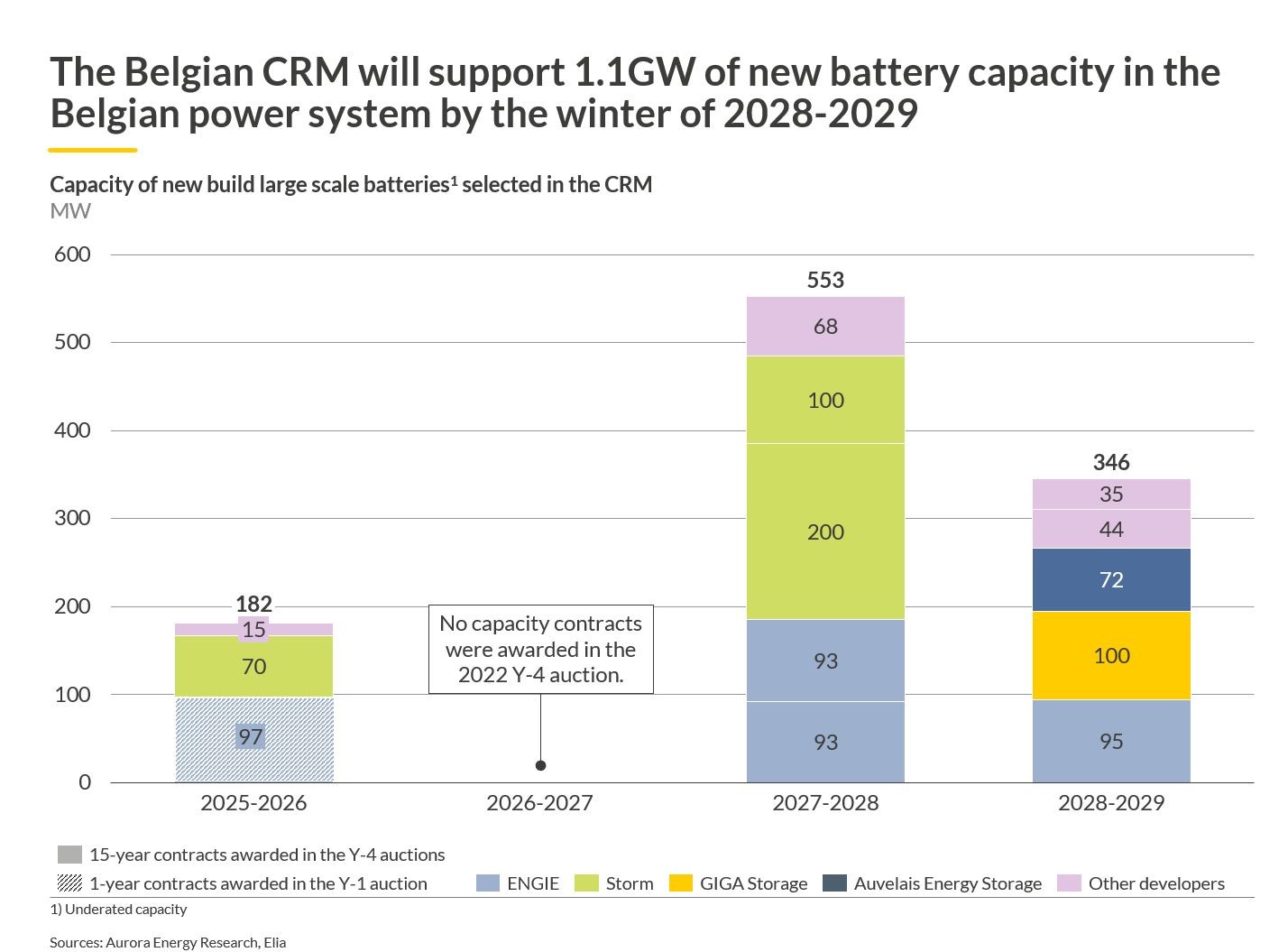

On the last day of October, system operator Elia published the results of the CRM auctions held this year, showing that a total of 450 MW of BESS had secured contracts. For the first time, two auctions were held simultaneously, namely the last auction (Y-1) for the 2025-2026 delivery year and the first auction (Y-4) for the 2028-2029 delivery year.

Elia announced that the goal had been achieved for the 2025-2026 delivery year: “security of supply is guaranteed, and sufficient volume has been contracted”. A total of 100 MW of BESS was contracted in this procurement exercise. For the 2028-2029 delivery year, an important first step has been taken with 350 MW of batteries selected in the Y-4 auction.

Aurora Energy Research calculates that over the past CRM auction rounds, 1.1 GW of new-build battery capacity was selected to receive capacity payments by winter 2028-2029. Over the past four auction rounds, a total of 13 new large-scale BESS projects were selected, with ENGIE, Storm, and GIGA Storage securing the largest contracts.

“We are indeed seeing that the CRM is ‘supercharging’ an already interesting battery market in Belgium. Other factors that make Belgium an appealing location for battery investments are the exemption of TSO grid fees and high revenues from balancing market (mainly FCR and aFRR),” Simon De Clercq, senior research associate at Aurora Energy Research, told ESS News.

CRM support is important for securing bank financing, as it provides guaranteed revenues and reduces investment risk. The auctions aim to maintain the security of the electricity supply after the Belgian nuclear phase-out, which had been planned to be completed by 2025.

“In 2022, the energy crisis led to a partial reversal of the Belgian nuclear phase-out. The lifetimes of the nuclear reactors of Doel 4 and Tihange 3, with a total capacity of 2.1 GW, were extended until 2035. This reduced the need for additional capacity in the Belgian power system. As a result, the 2022 CRM auction did not award any capacity contracts,” De Clerq said.

Upcoming procurements

Two further auctions are scheduled for the 2028-2029 delivery year: a Y-2 and a Y-1 auction. “There is over 2 GW of battery projects in the development stage in Belgium. We expect that these projects will compete for capacity contracts in the upcoming Y-2 and Y-1 auctions,” De Clerq said.

With the Y-2 auction, which will be held for the first time in 2025, support can be granted for multiple years, making it particularly appealing for battery projects. The Y-1 auction only grants one-year contracts. In the 2024 Y-1 auction, one battery project secured a one-year contract, competing mainly against gas-fired OCGTs and CCGTs.

Elia publishes the auction rules — including the derating factors, the price cap, and the volumes — in Q1 of the auction year. These will determine exactly how interesting the auctions are for batteries. With the CRM auctions being technology neutral, no specific storage duration is prescribed.

“The duration of the battery will result in a different derating factor of the bid,” De Clerq said. The derating factor is a percentage that reflects how much of a project’s total capacity is “usable” for ensuring grid reliability during periods of high demand or stress. For instance, if a battery has a derating factor of 50%, only half of its capacity is considered available for the CRM.

Longer-duration batteries have a higher derating factor. “Across the bids submitted in all CRM auctions, most batteries have had a duration of four hours,” De Clerq said. The derating factors for the 2024 Y-4 auction stood at 38% for a two-hour battery, 50% for a three-hour system, and 57% for a four-hour battery.

In announcing the procurement results in October, Elia mentioned that the Y-4 auction demand curve was higher than the supply and that all projects were contracted.

“There appears to be room for battery storage players to participate even more in the CRM auctions. Nearly 1.5 GW of capacity remains to be procured for the 2028-2029 delivery period through the Y-1 and Y-2 auctions, presenting significant opportunities for battery projects,” De Clerq says.

However, De Clerq underlines that this also indicates that only a relatively small share of the battery capacity in the pipeline is currently participating in the CRM auctions, even when they have a permit. “This indicates that other challenges exist to reach a viable battery investment case in Belgium,” he says.