US Energy Department $290m loan guarantee for Sunwealth virtual power plant

The US Department of Energy’s (DOE) Loan Program Office (LPO) has announced a, conditional commitment of up to $289.7 million to commercial solar company Sunwealth, to help finance Project Polo.

The project aims to deploy up to 1,000 solar and BESS in as many as 27 states.

The solar and energy storage systems would be primarily at commercial and industrial facilities and would create approximately 3,700 jobs, including more than 1,900 solar and storage installation jobs and more than 1,700 operations and maintenance roles.

The solar and storage sites would have an estimated aggregate capacity of 168 MW of solar and 16.8 MW/33.6 MWh of battery energy storage. Sunwealth estimates Polo Project would avoid up to 4.07 million metric tons of carbon emissions over the project’s lifetime.

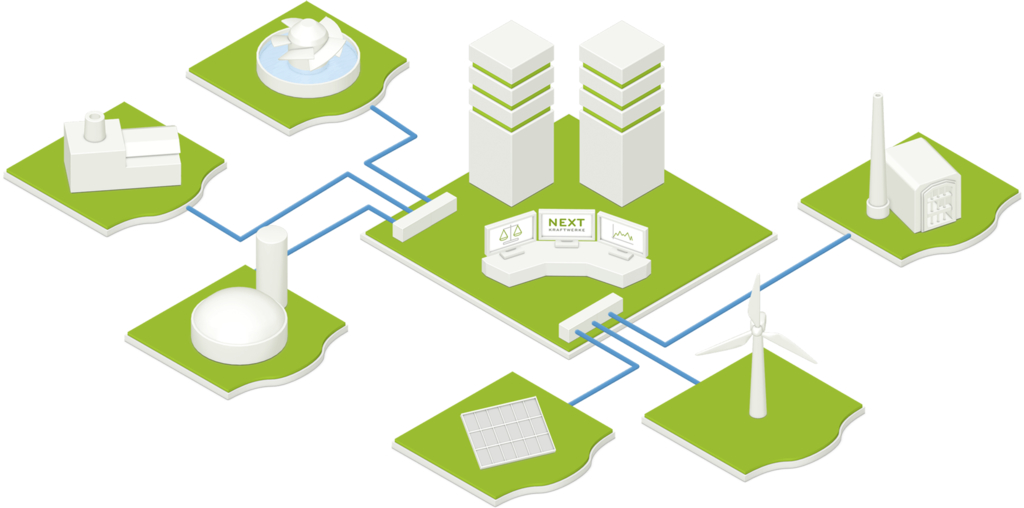

The commercial solar financier and developer has partnered with fellow Massachusetts company SYSO Technologies to provide its distributed energy management software platform, which will enable the project to function as a virtual power plant (VPP).

VPPs comprise aggregated small-scale, “distributed” energy resources (DERs) including solar arrays, electric vehicles (EVs), EV chargers, and demand-response devices such as water heaters, thermostats, appliances, and more.

VPPs

“Now is the moment to scale virtual power plants to meet the pressing needs that we have in this country,” said Mark Dyson, managing director of think tank the Rocky Mountain Institute, in a presentation during the pv magazine USA Week event. He said one such need relates to the incredible electricity demand growth the nation is experiencing, for the first time in 15 years.

Project Polo includes both customer side, “behind-the-meter” distributed energy resources and community solar projects, primarily targeting commercial and industrial properties. Project sites include building rooftops, parking lots, and underutilized land across the United States. The Sunwealth VPP will manage solar generation and energy storage, forecasting solar production, and the aggregation and dispatch of the DERs.

SYSO software manages the solar and energy storage units as a VPP to support grid stability and resilience while generating additional revenue by enabling participation of the DERs in VPP programs and wholesale energy markets. One challenge to aggregating such resources across states is that each independent system operator – which sits between energy generators and distributors– has its own requirements for solar and storage, as far as compliance and market participation is concerned. SYSO reports it has deep regulatory knowledge and customized strategies to help navigate complexities from state to state.

Community benefits

Participants in the LPO loan scheme must implement a comprehensive Community Benefits Plan to ensure they create well-paid community jobs and improve the wellbeing of residents and workers.

Sunwealth is committed to paying a living wage and provides a training program. It works with the International Brotherhood of Electrical Workers, the National Electrical Contractors Association, and local solar nonprofits and trade groups to integrate them into the developer workforce. In line with the Justice40 initiative, the company has historically deployed around 40% of its systems to benefit disadvantaged communities. For Project Polo, Sunwealth aims to install between 20% and 50% of solar-plus-storage systems in disadvantaged communities.

While the conditional loan commitment indicates the DOE’s intent to finance the VPP project, the DOE and the borrower must satisfy technical, legal, environmental, and financial conditions for the finance to be given and the DOE must complete an environmental review before deciding whether to enter definitive financing documents and fund the loan guarantee.

From pv magazine USA.