HMC Capital aquires Neoen’s Victoria assets for $611m

French renewables company Neoen has divested its operating assets and development pipeline in the Australian state of Victoria in an AUD 950 million ($611 million) sale to Sydney-based alternative asset manager Home Consortium Limited Capital (HMC).

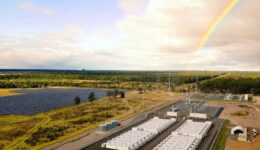

The 652 MW operating asset portfolio includes the 300 MW/450 MWh Victorian Big Battery, 13 km from Geelong. The other operational assets in Victoria are the 224 MW Bulgana Green Power Hub wind farm, 244 km northwest of Melbourne, which includes 20 MW of battery energy storage; and the AUD 198 million, 128 MWp Numurkah Solar Farm, 222 km north of Melbourne.

Neoen’s 2.8 GW development pipeline includes 1.3 GW of planned battery energy storage systems including the Bulgana Battery Extension, the Kentbruck Battery as part of the 500 MW/1 GWh Kentbruck Green Power Hub, the 300 MW/600 MWh Moorabool Battery, and the storage element of the Navarre Green Power Hub, which will feature a 600 MW wind farm. More than 1.5 GW of wind power generation capacity is included in the development pipeline, including the Loy Yang Wind Farm.

The sale of Neoen assets in Victoria comes after Canadian asset manager Brookfield Renewable Holdings reached an agreement with the ACCC to acquire a 53.32% controlling stake in the French developer, with a view to acquiring all of the business.

After the sale of its Victorian assets is complete, Neoen will have 3.7 GW of energy storage, wind and solar projects either in operation or under construction elsewhere in Australia. The developer said it is maintaining its intention to reach 10 GW in operation or under construction by 2030.

Neoen Australia CEO Jean-Christophe Cheylus said the legacy of the company’s Victorian portfolio is one to be proud of and represented a significant contribution to the state’s energy transition.

“We remain deeply grateful for [the] strong support of [regulator] the Australian Energy Market Operator (AEMO) and the Victorian government and we will continue to work diligently over the coming months with HMC Capital and with our host landowners and project communities to facilitate a smooth handover,” Cheylus said. “With renewed focus, we now redouble our efforts towards realizing our ambition of 10 GW in Australia by 2030.”

Neoen Chairman and CEO Xavier Barbaro said the divestment is a necessary step for the company to begin a new chapter under Brookfield’s ownership. “We remain fully committed to Australia, which is our largest country, and we look forward to benefiting from Brookfield’s support as we seek to further accelerate the energy transition in Australia and around the world,” said Barbaro.

HMC Capital

Julia Gillard, chair of energy transition at HMC Capital, said the the acquisition is a significant step in the business’ ambition to be a national champion of Australia’s transition to a net zero carbon economy by 2050.

“This is a marquee acquisition to further seed HMC’s Energy Transition platform, encompassing a diversified range of renewable energy generation and storage assets,” said Gillard. “We look forward to partnering with some of Australia’s leading institutional investors in creating a clean energy future and fighting against climate change.”

HMC Capital head of energy transition, Angela Karl, said the acquisition will cement the asset manager’s Top 10 position for renewable energy and energy storage in Australia’s National Energy Market, from day one. “We look forward to working collaboratively with Neoen, our customers, our landowners, and other key stakeholders to implement a smooth transition,” said Karl.

From pv magazine Australia.