Ace Green Recycling to list on NASDAQ, build battery plants in US

Ace Green Recycling, a United States-based developer of recycling technologies for both lead-acid and lithium-ion batteries, has announced its intention to become a public company and list on NASDAQ.

The company has entered into a definitive business combination agreement with Athena Technology Acquisition Corporation (ATAC II), under which the special purpose acquisition firm will merge with Ace. The merger means Ace will become a wholly owned subsidiary of ATAC II. Ace’s operations will become the operating business of the combined entity.

The deal is expected to close in the first half of 2025, subject to regulatory conditions and court approvals. Ace has been assigned an equity value of $250 million and expects to obtain financing from existing insiders and other key investors.

While Ace is active in several global markets, its CEO and founder Nishchay Chadha, said the United States will be key to its future expansion plans. “Our planned focus on the US market makes listing on a US exchange a strategic move that better aligns our goals with our core stakeholders.”

These include Claude Dauphin Family Office, former executives at Trafigura, Circulate Capital, and the Francis Family Fund ApS – all big investors in metals and recycling.

Ace is incorporated in Delaware with a commercial headquarters in Houston, Texas. It is planning to develop a flagship battery recycling plant in Texas for lead and lithium-ion batteries.

Chandha added the company’s technology scope is very much a global one. “Ace is advancing electrification by building a global recycling technology to create sustainable supply chain solutions for critical metals that will enable next-generation technologies.

“Compared to other recyclers, we employ a modular, fully electrified, low CapEx strategy, addressing two distinct and sizeable markets in lead and lithium-ion batteries. We believe that this approach will allow us to rapidly achieve commercial scale while diversifying both our feedstock and end-markets,” Chandha said.

The company has commercial operations in Asia, with offices and plants in Singapore and India. It is working on lead battery recycling plants in South Africa and Israel, as well as lithium battery recycling plants in Europe.

Its clients come from across the entire battery value chain, and it collaborates with various industry partners to establish new facilities with a view to making critical battery waste materials from graphite to lithium carbonate easily recyclable on a local level.

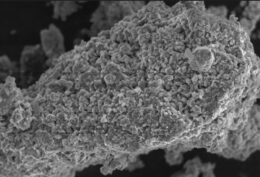

Its LithiumFirst™ technology is capable of commercially recovering up to 75% of lithium with a purity exceeding 99% from lithium iron phosphate and Nickel Manganese Cobalt (NMC) batteries. As well as recovering lithium, the LithiumFirstTM technology also recovers NMC salts, graphite, iron phosphate and other materials such as plastics, steel, aluminum and copper by utilizing a closed-loop hydrometallurgical process that avoids pyrometallurgical operations and produces no liquid waste or Scope 1 carbon emissions.

Ace’s GREENLEAD® Recovery Technology is a fully electric process that produces no Scope 1 emissions and can recover up to 99% of battery-grade lead with more than 99.98% purity.

The process is designed to replace legacy smelting operations, which are harmful to the environment, as well as human health due to potential lead poisoning.

The company collaborates with players across the automotive, energy storage, and electronics sectors.

One of its collaborators is recycling giant Glencore, with which it has a 15-year offtake agreement. It has also licensed its technology to ACME Metal in Taiwan and it collaborates with R&D institutions such as the Indian Institute of Technology and Singapore Polytechnic on battery recycling topics.