Innergex Closes $142 Million Bridge Loan For The Hale Kuawehi Solar and Battery Storage Project in Hawaii

Innergex Renewable Energy Inc. has closed a US$100 million (CAN$142 million) non-recourse bridge loan with First Citizens Bank to support the Hale Kuawehi project through its final stages and repay the corporate revolving credit facility, effectively reducing corporate leverage.

“This financing initiative reinforces Innergex’s commitment to maintaining a strong balance sheet, positioning us for continued financial flexibility and growth as we expand our presence in our key markets,” said Michel Letellier, President and Chief Executive Officer of Innergex. “Our Hale Kuawehi solar and battery storage project is nearing completion. With the construction phase now fully completed, we are focused on advancing the project toward full commissioning.”

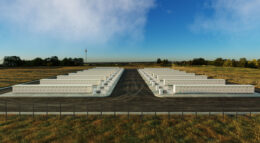

Hale Kuawehi’s substation and interconnection points have been successfully energized earlier this month, marking a critical milestone for the advancement of the project. With the construction phase now fully completed and the project officially connected to the grid, the focus shifts to commissioning the installation (solar panels, inverters, and storage systems), bringing the project to full operational status in Q1 2025.

Upon its commissioning, the project’s revenues will be secured through a 25-year power purchase agreement with Hawaii Electric Light Company. In addition, the project is eligible to receive a federal Investment Tax Credit (ITC) sized to approximately 30% of the project’s eligible costs.

The construction bridge loan is expected to be repaid with the proceeds from a future long-term non-recourse financing after the facility reaches commercial operation.