Aluminum maker to acquire Northvolt’s battery recycling business

Norwegian aluminum maker Norsk Hydro is reportedly set to acquire the remaining shares in the Hydrovolt battery recycling business in which it is a stakeholder alongside troubled Swedish battery maker Northvolt.

Norsk Hydro, in which Norwegian government organizations hold a 40% stake, expects to complete the acquisition of the remaining stock in the battery recycler before April 2025, according to Reuters, and reportedly told the agency it has been financing Hydrovolt’s operations since July 2024.

The acquisition is reportedly subject to approvals by the United States District and Bankruptcy Court’s Southern District of Texas after Northvolt applied for Chapter 11 bankruptcy protection in the United States in November 2024.

Reuters said Norsk Hydro will pay NOK 78 million ($6.8 million) to purchase the remaining stock in Hydrovolt.

The aluminum maker told Reuters the move did not contradict a statement it made in November 2024 in which it said it would halt battery company investment.

“We view Hydrovolt a bit different from our other battery operations,” a Norsk Hydro spokesperson quoted in the Reuters report said. “Hydrovolt has a recycling element that is closer to Hydro’s other operations. Battery recycling is something we discuss with our customers within the automotive industry who we deliver aluminum to, so there are quite a few synergy effects here.”

The spokesperson told the agency Norsk Hydro would seek to bring on a board a new partner in the Hydrovolt business and did not intend to acquire Northvolt’s on-site battery materials recycling unit Revolt.

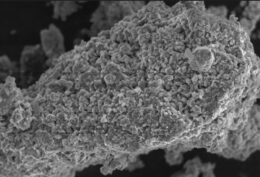

Norsk Hydro would continue to supply Northvolt with the black mass material recovered from recycled batteries, the company told Reuters.

The agency reported Northvolt must update bankruptcy court judge Alfredo R. Perez on its funding, on Jan. 28, 2025, around the time a $100 million bankruptcy loan from Volkswagen-owned truckmaker Scania is due to expire.

Reuters said Northvolt, which is reining in non battery cell manufacturing activity in the face of a financial crisis, had only $30 million in cash – enough to fund operations for a week – when it applied for bankruptcy protection in November 2024.