Sodium-ion batteries face uphill struggle to beat lithium-ion on cost

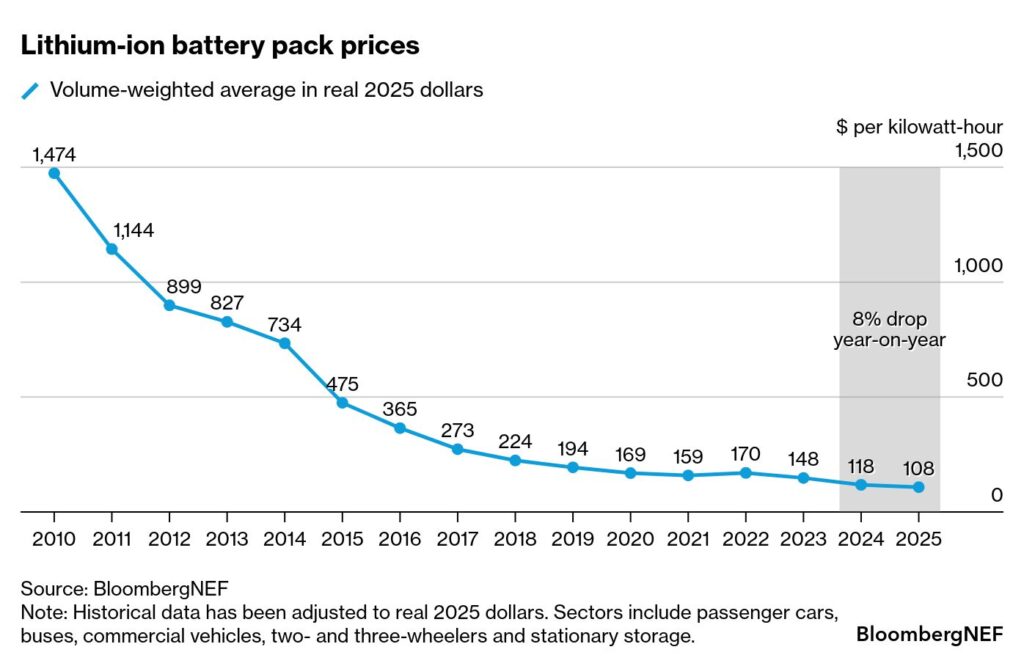

In recent years, sodium-ion batteries have emerged as a key contender to the dominant lithium-ion technology, which has experienced supply shortages and price volatility for key minerals. While often described as a cheaper alternative, primarily thanks to abundant sodium and low extraction and purification costs, a new study finds that sodium-ion batteries will require a set of technology advances and favorable market conditions to approach incumbent lithium-ion on price.

A group of researchers at Stanford University has assessed the techno-economic competitiveness of sodium-ion batteries over 6,000 scenarios while varying technology development roadmaps, supply chain scenarios, market penetration and learning rates. As a result, they identified several sodium-ion pathways that might reach cost-competitiveness with low-cost lithium-ion variants in the 2030s.

One of the most impactful ways to improve competitiveness is increasing sodium-ion energy densities to decrease materials intensity. At this point, the cost per unit of energy stored remains higher for lower-density sodium-ion batteries, and this could potentially limit its widespread adoption.

Most important is to increase energy densities without the use of critical minerals. Specifically, developers should target lithium-iron-phosphate energy densities while moving away from nickel, the researchers suggest. Currently, most leading sodium-ion designs rely on the relatively expensive metal.

Whereas cathodes are the key cost driver for lithium ion, the anode is the most expensive component in sodium ion batteries. Stanford researchers, therefore, identify increasing the specific capacity of hard carbon anodes as yet another critical design direction. Replacing hard carbons with alloying-anodes, such as tin, is one of the possible approaches. An alternative design direction is to forgo an anode material altogether and opt for an anode-free cell configuration.

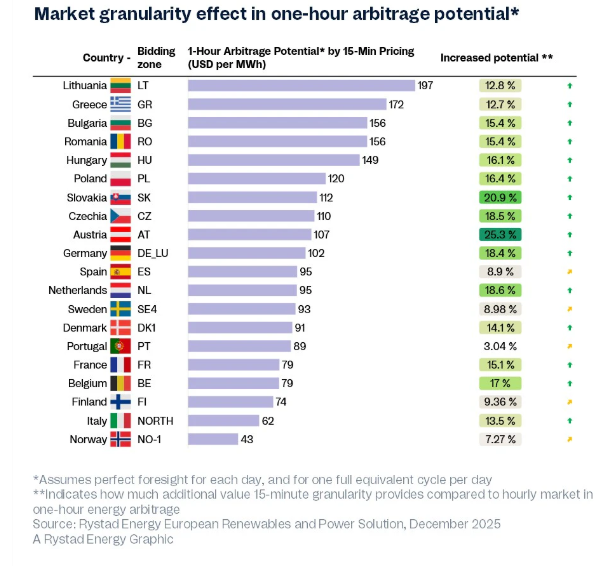

The researchers also showed that timelines are highly sensitive to movements in critical minerals supply chains—namely that of lithium, graphite and nickel. For example, if lithium prices continue where they are today near historic lows, sodium-ion has a narrower set of technology routes to become price advantageous in the next decade.

In conclusion, they observed that engineering advancements are a greater lever to affect prices than the limited room for materials price reductions via learning-by-doing and scaling production. However, all modelled outcomes suggest that being price advantageous against low-cost lithium-ion variants in the near term is challenging.

The study titled Critically assessing sodium-ion technology roadmaps and scenarios for techno-economic competitiveness against lithium-ion batteries published in Nature Energy concludes that sodium-ion deserves significant research, development, and commercialization attention.

“We caution against assumptions and promises of immediate or near-term (pre-2030) price advantage against Li-ion, specifically LFP, but believe it has a critical role to play in the energy transition as a viably scalable Li-ion substitute under circumstances of supply chain volatility. Therefore, we believe investing in Na-ion development roadmaps to maintain a competitive track with Li-ion would be prudent. In the same vein, investments in Li-ion supply chain security should not be foregone given the demonstrated sensitivity to supply shocks,” the study reads.

The study is the first by a new partnership between the Stanford Doerr School of Sustainability’s Precourt Institute for Energy and the SLAC-Stanford Battery Center. The new program, STEER, assesses the technological and economic potential of emerging energy technologies and advises “what to build, where to innovate, and how to invest” for the energy transition.