Gresham House, Octopus sign two-year, fixed-price BESS deal

Gresham House Energy Storage Fund and a subsidiary of Octopus Energy, one the UK’s largest electricity providers, have signed two-year fixed price contracts for 14 projects, totalling 568 MW/920 MWh of capacity.

The tolling agreement deal covers around half of Gresham House’s portfolio, targeted at 1,072 MW for the second half of 2024. Contracts will commence in a phased manner from July 1.

Under the new agreement, Octopus will pay a fixed fee per MW in exchange for taking over each project’s batteries. The fixed fee is determined by the duration of the asset and it excludes Capacity Market payments, which the projects will continue to receive separately.

In a webinar supporting the announcement, Ben Guest, fund manager of Gresham House Energy Storage Fund plc and managing director of Gresham House New Energy, said the fixed prices in the contracts were higher than the revenues achieved in the first four months of 2024.

Between the new tolling agreement and existing Capacity Market revenue, around two-thirds of Gresham House’s portfolio is now contracted.

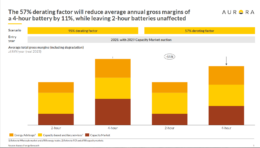

Gresham House’s decision to contract the majority of its portfolio revenue comes at a time of transition for Great Britain’s balancing market, and battery revenues have been in decline. Given that context, Guest said a two-year contract “feels like the right level” to see the fund through a period of uncertainty.

“This is a source of diversification of revenues. We’ve now got a mix of contracted and merchant revenues. It’s not forever and we’re very confident the merchant environment will improve, so this feels like the right amount of time to do this,” he said.

In operational terms, Octopus can use the 14 projects as it sees fit under each site’s technical restraints. This might include trading in the ancillary and wholesale electricity markets, as well as with the electricity system operator through the balancing mechanism.

Limit the exposure to market prices

The deal should also limit the supplier’s exposure to market prices when it needs to take balancing action. Hardware and software from Octopus subsidiary Kraken will be used across sites for asset management.

Wendel Hortop, markets lead at battery analytics platform developer Modo Energy, told pv magazine Energy Storage the announcement of a tolling agreement was not a surprise, given the low revenues for batteries currently seen in Great Britain’s wholesale market.

“We estimate the tolling arrangement to be worth GBP 56,000 ($71,584) per MW per year, this is above where revenues are today but in line with forecasts in the space,” he said, “although it’s worth noting that this revenue is below what would have been expected only a year ago.”

Hortop added that Modo expects other investors will have considered tolling agreements.

“The deal might push others to make that jump,” he said.