Solid-state delays helping existing chemistries, says Goldman Sachs

New analysis from Goldman Sachs Research points at further declines in battery pricing, mirroring analysis from the wider industry and continuing trends followed through the past 18 months and beyond. The study also delved into the ongoing battery chemistry fight as the industry continues to see the expansion and refinement of lithium iron phosphate (LFP) chemistries.

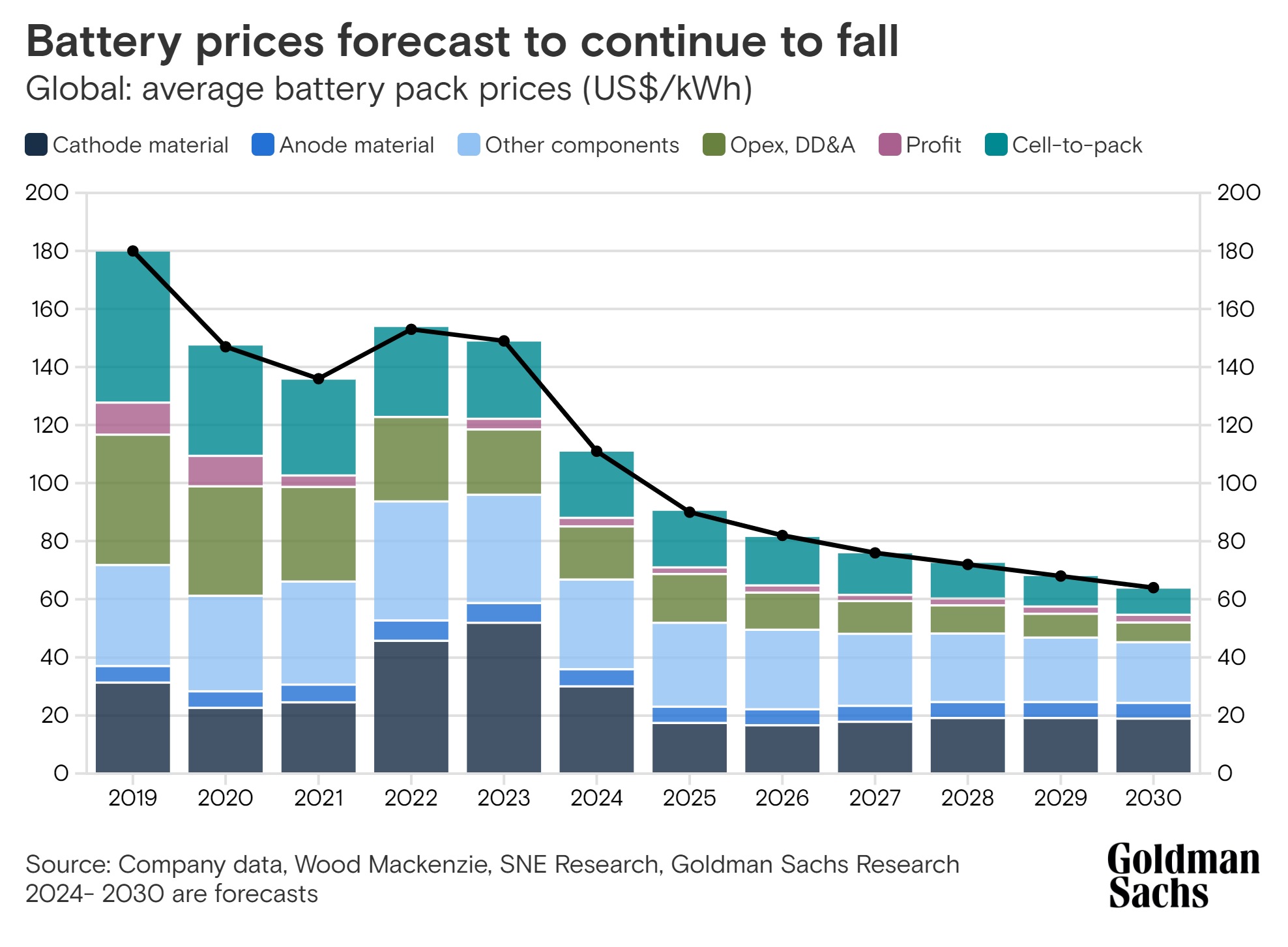

The bank’s research arm focuses chiefly on the EV side of the battery equation, noting that battery pack prices are down 25% on last year to $111 per kilowatt-hour (kWh), and average battery prices are likely to fall towards $80/kWh by 2026.

Further, the firm says global average battery prices declined from $153 per kilowatt-hour (kWh) in 2022 to $149 in 2023, and they’re projected to fall to $111 by the close of 2024. The firm forecasts prices further out to 2030.

The implication is that stationary storage prices follow broader trends led by the larger EV battery market.

Relevant highlights for stationary storage came from quotes from Nikhil Bhandari, co-head of Goldman Sachs Research’s Asia-Pacific Natural Resources and Clean Energy Research, who offered a few nuggets for the industry.

In terms of broadly understood trends, Bhandari noted that costs are falling in general batteries due to battery metal prices and technical innovation, thanks to new products packing 30% higher energy density, while also lowering costs of production via the shift to cell-to-pack being seen in EVs.

The associated chart breaks down the information further:

Solid-state still missing

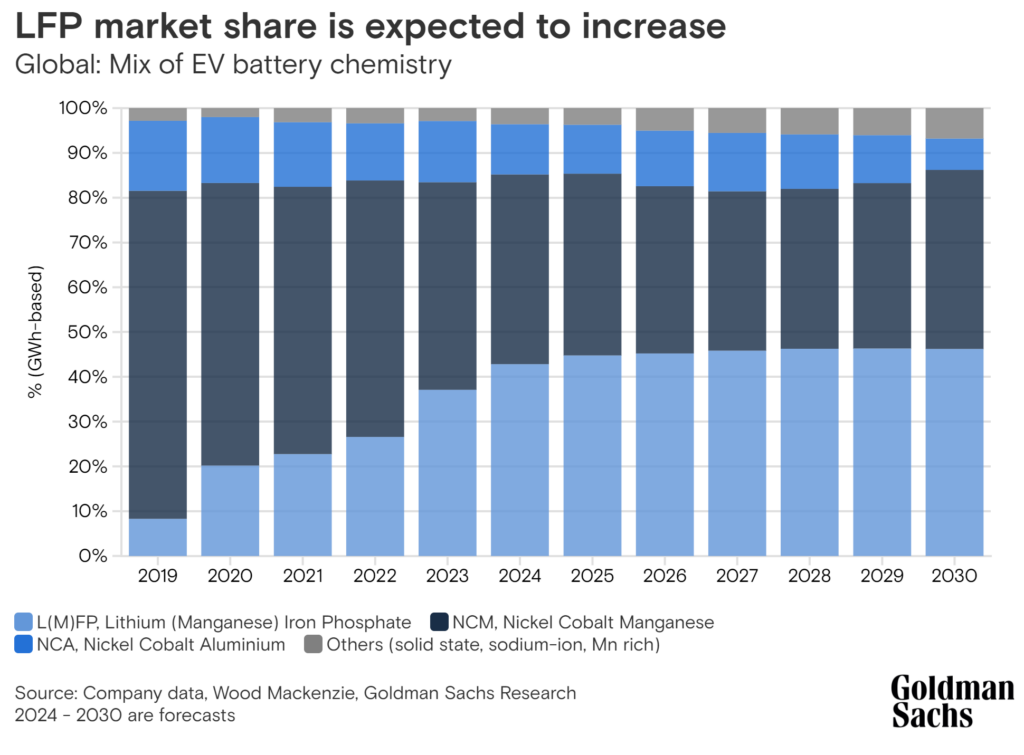

A strongly relevant question-and-answer part of the report related to the ongoing R&D push into lithium-ion batteries, and solid-state batteries, versus other concepts and materials. The waiting issue for solid-state batteries may give existing lithium-based chemistries a longer lifespan at minimum, with a boost to LFP chemistry seen in Goldman’s projections.

Quote:

Goldman: Do you expect the leading battery types to stave off the competition?

Bhandari: In the future, we’ll be talking about solid state batteries, which could be a real game changer, because the technology can increase your energy density more materially and is slightly safer because there is no flammable liquid electrolyte.

We were assuming that newer batteries like solid state would capture about 5-10% of the market along with sodium ion batteries, but that hasn’t happened. Solid state was initially supposed to come out by now, and it’s been pushed out to the later part of this decade because of challenges in moving from lab scale to mass production.

In the meantime, the existing lithium-based chemistries are going to get stronger and stronger, and that’s going to make it difficult for solid state batteries to eventually replace the existing technology. We have actually raised our expectation for LFP batteries to increase their market share from 41% of the market to 45% in 2025, with advanced nickel batteries continuing to dominate the higher energy competition.