Neoen lands $890m loan for additional 1.3 GW of renewables in Australia

French renewables developer Neoen has more than doubled the size of its Australian clean energy portfolio finance by securing a further AUD 1.4 billion of debt for an additional 1.3 GW of wind, solar, and energy storage assets.

Neoen Australia Chief Executive Officer Jean-Christophe Cheylus said the transaction underlined the depth of the company’s portfolio in Australia.

“It serves to strengthen our owner-operator business model and provides us with a solid foundation for future growth,” Cheylus said.

The debt, with maturity of 5.5 years and seven years, will finance three operational solar projects in New South Wales (NSW): the 36 MW Griffith Solar Farm, 7 km from the Riverina regional city of Griffith; the 66 MW Parkes Solar Farm, 10 km west of Parkes; and the 28.7 MW Dubbo Solar Hub, comprising two sites, in Dubbo and the neighboring town of Narromine, 25 km to the west. The 157 MW Kaban Green Power Hub wind farm, in Queensland, will also be financed, as will the first stage of the 270 MW/540 MWh Western Downs battery, also in Queensland.

The loans will also back two under-construction sites. The 440 MWp Culcairn Solar Farm, in NSW, has a four-year power purchase agreement with London-headquartered Smartest Energy for half of its output, and a long-term energy services agreement with the NSW government and is on track to be operational in 2026.

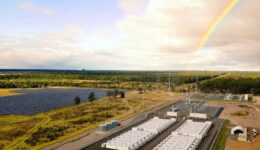

The 341 MW/1,363 MWh stage two of the Collie Battery, in Western Australia, has a 300 MW/1.2 GWh capacity services contract with the Australian Energy Market Operator and is on track to be completed in 2025.

The debt is being provided by 11 lenders: ANZ, Bank of China, the Clean Energy Finance Corporation, HSBC, ING, KfW IPEX-Bank, Mizuho, Mitsubishi UFJ Financial Group, Sumitomo Mitsui Banking Corporation, Societe Generale, and Westpac.

The deal builds on Neoen’s first tranche of portfolio debt finance, which was announced in February 2024.

Neoen’s chairman and CEO, Xavier Barbaro, said the new debt demonstrated Neoen’s ability to create value thanks to its maturing and diversified asset portfolio and further cemented the company’s ambition to play an active role in the energy transition in Australia and around the world.

From pv magazine Australia.