Opinion & Analysis

Advertisement

Advertisement

Advertisement

Latest News

Advertisement

EU Battery Regulation is coming

Manufacturers and suppliers of batteries for photovoltaic energy storage must meet more extensive requirements under the new EU battery regulation. Many companies are still unsure what this means for their product design, processes, and management systems. Yalcin Ölmez, head of the operational and investment risks department at German testing body TÜV SÜD, explains what companies now need to consider.

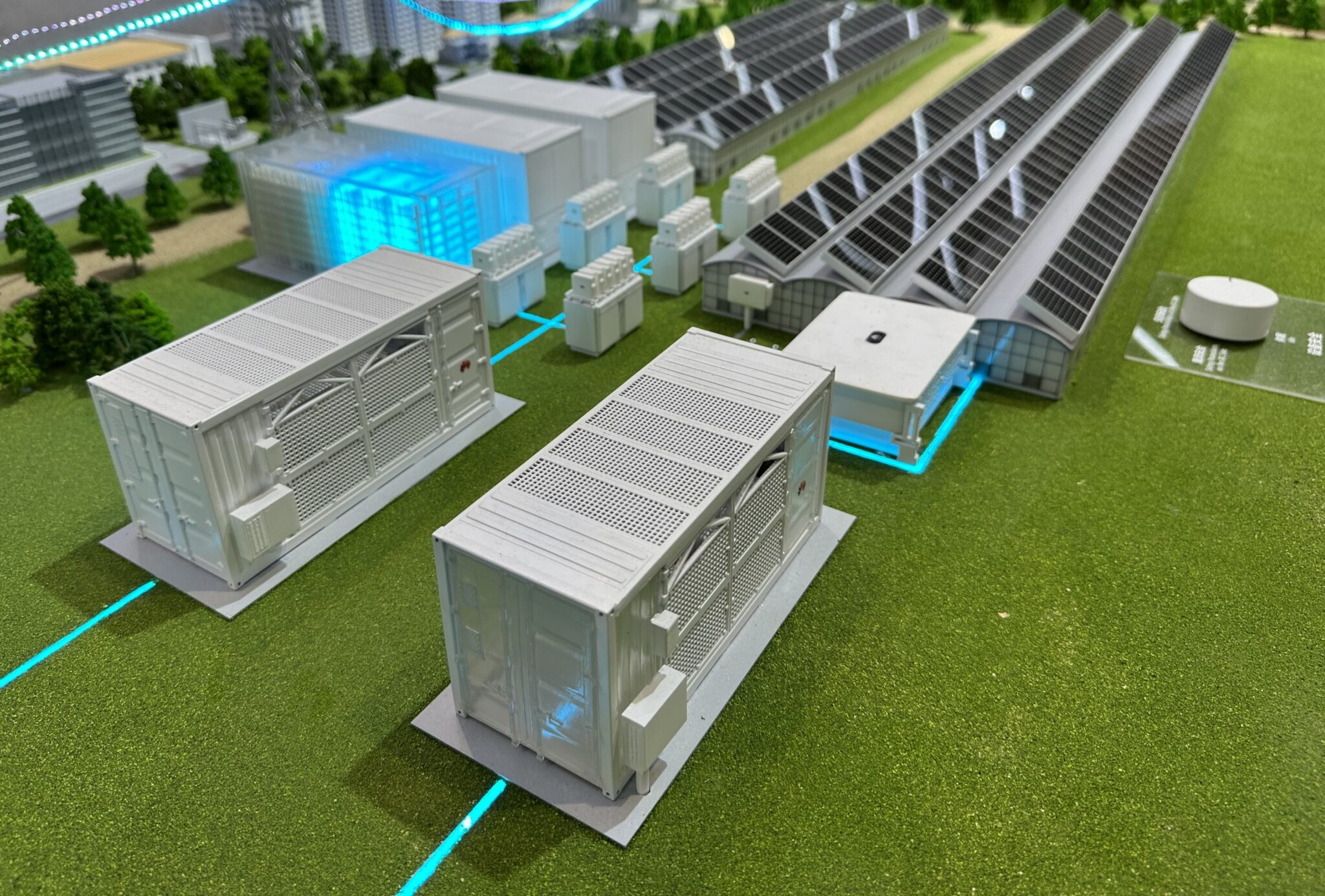

BESS are becoming more attractive

As battery energy storage system costs plunge, energy price volatility is shortening payback times for storage solutions. This shift, driven by a surge in intermittently generating renewables, and ongoing innovations in battery manufacturing, marks a pivotal moment for energy markets worldwide.

The MENA region – the next hot market for energy storage!

“The MENA region – the next hot market for energy storage?” I asked in an article back in October 2017. It took a bit longer than I expected, but seven years later it’s time to replace the question mark with an exclamation mark. It’s hot indeed.

Standalone battery storage in Romania: PUZ or Pause

As the Romanian Ministry of Energy takes steps to encourage investments in standalone battery energy storage systems (BESS) through support schemes and an improved tariff regime, one regulatory challenge seems to have caught both investors and local authorities off-guard: a zonal urban plan (PUZ) is still necessary for developing standalone BESS on extra muros agricultural land. Mihaela Nyerges, managing partner, and Paraschiv Sandu, associate at Nyerges & Partners, are elaborating on the requirements.

All Opinion & Analysis news

Global battery market glut: Will oversupply benefit India’s 1 GW/4 GWh ESS tender process?

Oversupply in the global battery market is likely to influence the price discovery of a major tender process in India for 2 GW solar with 1 GW/4 GWh ESS, writes Ali Imran Naqvi, executive director (ED), Gensol Engineering Ltd.

Battery storage on a capacity market

In Germany – but not only there – there is a heated debate about the pros and cons of a capacity market. The German Renewable Energy Association is against it, and recently the German New Energy Industry Association, the DIHK and the EEX energy exchange have also taken a clear stance: Germany does not need a “power plant subsidy program.” In this article, four experts explain why battery storage can also play an important role in a capacity market and make recommendations on how the design of the market can help avoid mismanagement, wrong incentives and unnecessary costs.

Advertisement

Tesla continues scaling up energy storage business in China

The announcement of Tesla's battery factory in Shanghai marked the company's entry into the Chinese market. Amy Zhang, analyst at InfoLink Consulting, looks at what this move could bring for the US battery storage maker and the broader Chinese market.

Tackling merchant risk – A deep dive into Europe grid-scale energy storage contracted revenue

Current market conditions are propelling grid-scale project deployment in a more diversified European energy storage market. Anna Darmani, principal analyst – energy storage EMEA, at Wood Mackenzie, examines revenue streams in different parts of Europe and emerging routes to the market.

How grid operators and renewable energy producers can use batteries to develop a flexible energy system

As the urgency of mitigating the impacts of climate change intensifies with each passing year, it is the collective responsibility of grid operators and renewable energy producers to spearhead the transition to a renewable energy system.

Advertisement

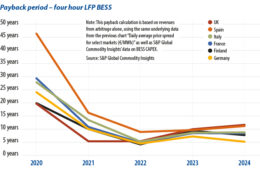

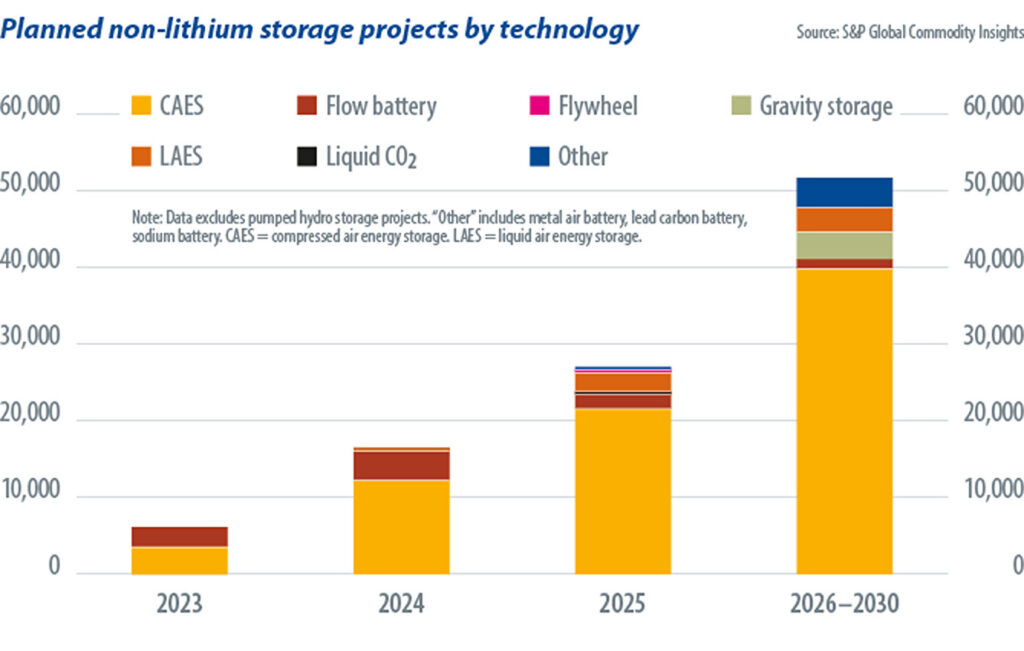

China’s battery price war catalyses global energy storage innovation

The plummeting costs of energy storage, driven by China’s relentless price war, are expected to catalyse more economic deployments worldwide. Lithium iron phosphate (LFP) batteries are surging in market share due to their lower costs and higher cycle life compared to nickel-based lithium-ion batteries.

The prospects for battery investment in Germany

Merger and acquisition (M&A) activity has been heating up in Germany but increased competition and high interest rates are affecting renewables project values. Baris Serifsoy, partner at GreenCap Partners, examines the investment landscape in one of the world’s most developed PV markets.

Advertisement