China scales up long-duration storage with 4.2 GWh compressed air project

China is moving ahead with one of its biggest compressed air energy storage (CAES) projects after officials in Sanmenxia’s Shanzhou district cleared a proposal for a 700 MW/4,200 MWh long-duration storage plant from Zhongchu Guoneng (Beijing) Technology Co., Ltd. (ZCGN), the country’s leading CAES developer. The six-hour-duration system marks a major step in Henan’s drive to create a modern grid capable of integrating growing amounts of intermittent renewable generation.

With its filing approved by the local Development and Reform Commission on November 24, the project is expected to commence construction in 2026, subject to environmental, land-use, and planning clearances. Once operational, it will be one of the country’s most significant standalone physical-storage assets, supplying peak-shaving, frequency regulation, and reserve capacity to western Henan.

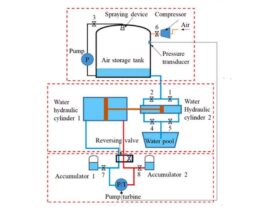

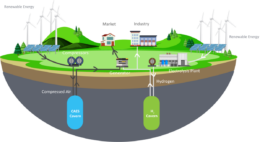

The facility will employ advanced CAES technology developed by the Institute of Engineering Thermophysics of the Chinese Academy of Sciences and commercialized by ZCGN. The system stores compressed air in an underground cavern during off-peak periods and releases it during peak demand to power an expansion turbine.

The architecture includes a high-capacity compression station, an underground cavern for high-pressure air storage, expansion turbine–generator sets, a high-efficiency thermal-storage unit that recovers compression heat, and an intelligent control system for real-time dispatch and safety.

The design provides decoupled power and energy capacity—a defining characteristic of CAES. Power output is determined by the compressor–expander machinery, while total stored energy depends on cavern volume, allowing capacity expansion without modifying the power block. With an expected operating life of more than 25 years, the project offers longer service duration than lithium-ion systems and eliminates thermal-runaway concerns.

Although final investment details have not been revealed, comparable projects – including a 700 MW/2800 MWh CAES installation in a neighbor province – involve CNY 4.8bn–6.0bn ($677-$847 million) in capital expenditure. Considering the longer six-hour duration, the Shanzhou plant is expected to fall toward the upper range.

Henan’s grid is facing increasing volatility as renewable penetration grows. By providing 4.2GWh of dispatchable storage, the CAES station will help stabilize regional load curves, enhance renewable-power consumption and strengthen power-supply security for Sanmenxia and neighboring cities. The project aligns with national strategy: CAES is designated in China’s 14th Five-Year Plan as a cornerstone technology for large-scale, long-duration storage.

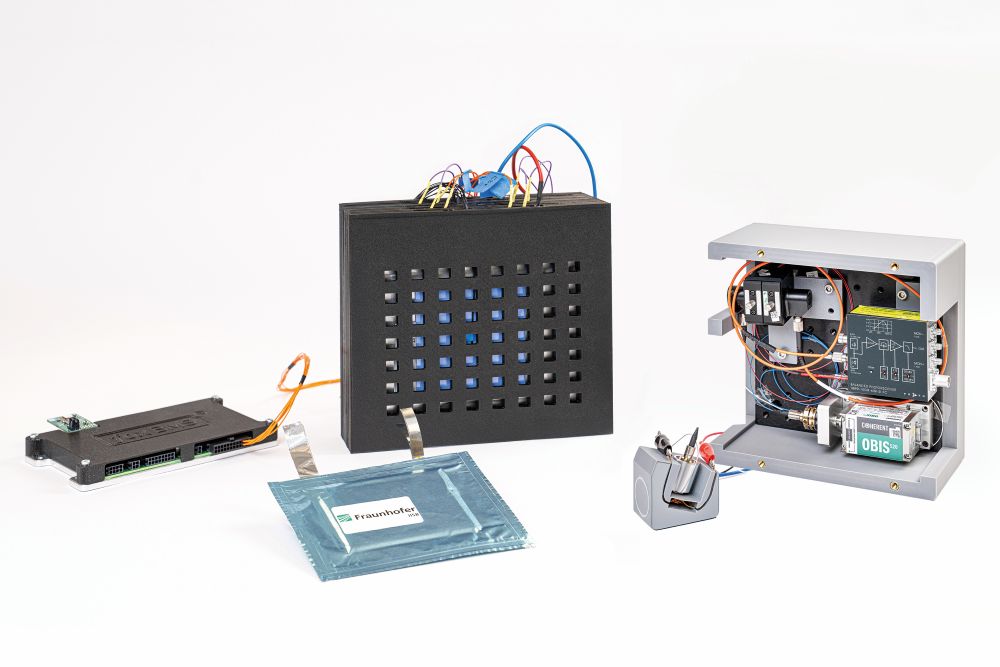

ZCGN, the commercialization platform of the Institute of Engineering Thermophysics, has become China’s dominant CAES developer. Supported by four financing rounds totalling CNY 1.66bn and strategic investors including China Development Bank Capital and China Three Gorges New Energy, the company integrates R&D, engineering, equipment manufacturing, EPC services and plant operations.

ZCGN commissioned China’s first salt-cavern CAES plant — the 10 MW Feicheng demonstration project — in 2021, marking the transition from laboratory validation to commercial deployment. This was followed by the 100 MW Zhangjiakou project, the world’s first CAES plant built around a 100,000-cubic-metre artificial cavern, enabling CAES deployment in regions without salt formations.

In April 2024, the company completed its flagship installation: the 300 MW/1,800 MWh Feicheng advanced CAES national demonstration project, currently the world’s largest and most efficient CAES facility. With a reported 72.1% system efficiency, fully localised equipment supply and annual generation of around 600 GWh, the facility reduces coal consumption by nearly 190,000 tonnes and CO₂ emissions by 490,000 tonnes per year. Technical advances – including high-efficiency multi-stage compression, ultra-critical thermal storage and improved expander design – have cut unit costs by more than 30% versus the earlier 100 MW project.

Analysts estimate current CAES capital cost in China at CNY 800–1,500/kWh, with lifecycle electricity cost of CNY 0.20–0.30/kWh, approaching the economics of pumped hydro but with more flexible siting conditions.